- Orbital Insight Blog

- Global Real Estate Trends: Asian Malls & Hospitality

Blog

Global Real Estate Trends: Asian Malls & Hospitality

GO Highlights Global Parallels In Realty & Retail

The American Dream is finally here. But it took its developers more than 15 years to realize their dream of bringing the best of shopping and fun to the Western Hemisphere’s largest theme park mall in New Jersey.

New retail complexes keep popping up across the United States, even as talk of a mall glut and the so-called Retail Apocalypse foretell more bleak predictions than bright for the industry.

While e-commerce behemoths like Amazon appear to have infinite growth potential, Orbital Insight’s research shows that brick-and-mortar malls move from the “survive” mode to “thrive” when they start thinking about “lifestyle” instead of “just shopping” — as the American Dream has set out to do.

But whether a mall is drawing blockbuster crowds or not, what’s important to note is that it remains under the constant watch of investors, sector analysts, peers, realty developers and city authorities monitoring for signs of growth, distress, and related impact. This is a universal truth, applicable in most parts of the urban world, as our research shows.

Shown here are select real estate and mall locations in Asia and their activity timelines seen from the perspective of our GO platform, which leverages on anonymized device pings that translate into foot-traffic at the sites.

Device-date aside, GO also utilizes object detection and movement-based intelligence for a richer cadence of information that results in more efficient analysis and decision-making.

Computer vision is another technology we deploy, using geospatial imaging constructed with the aid of geometry, physics, statistics, and learning theory.

The Philippines: New Mall & Impact To Local Area

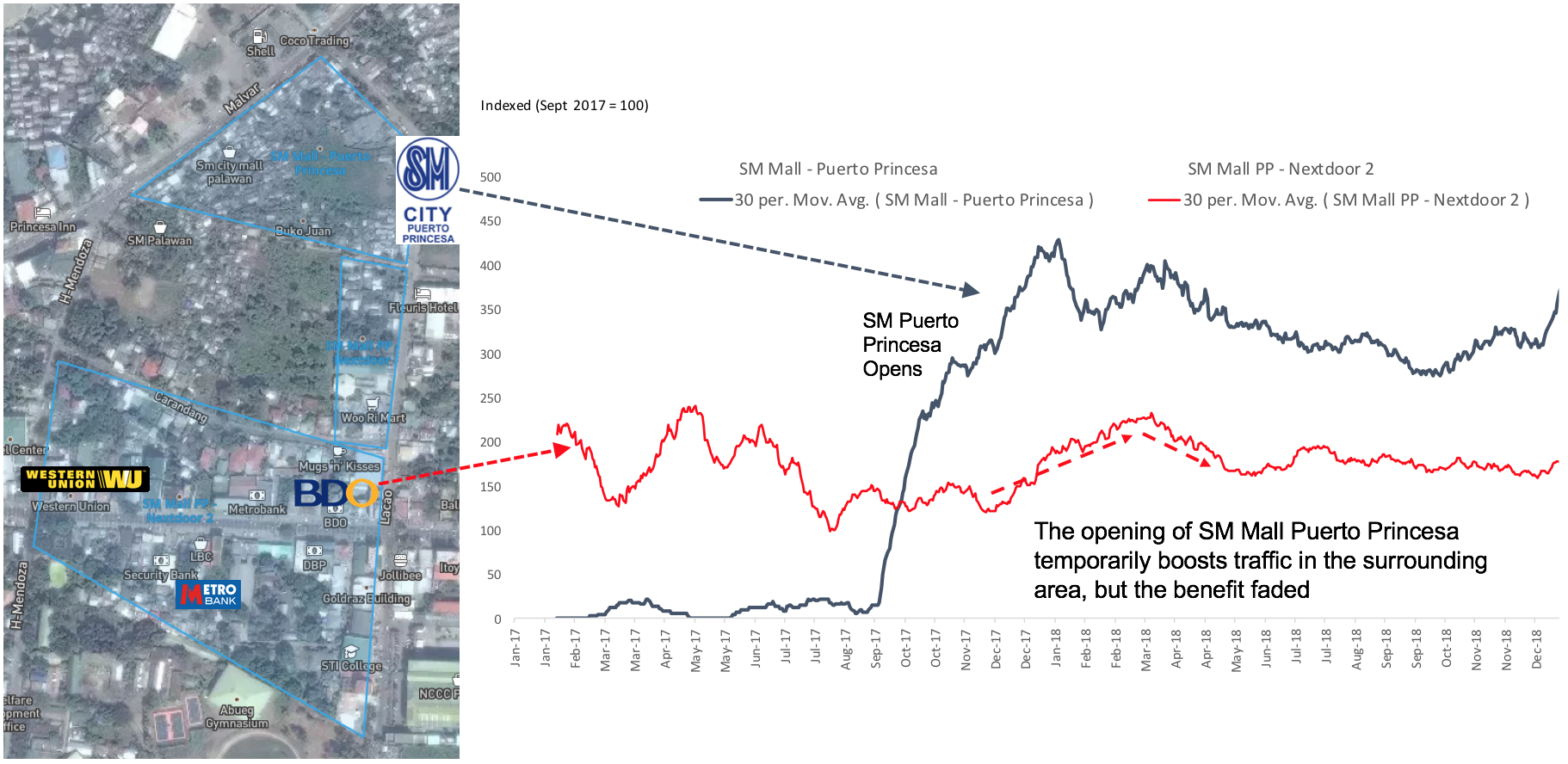

New mall openings often result in crowd spikes, not only at the malls themselves but also in adjoining areas that could bring a positive impact to other businesses.

An underperforming mall might have less than desirable foot-traffic but it is still watched by investors, sector analysts, peers, realty developers and city authorities looking for signs of improvement and related impact to the Area of Interest (AOI) around it.

Seen here is the impact from the opening of the SM Mall Puerto Princesa in Palawan, Philippines, which led to a temporary traffic spike in its vicinity.

Philippines: Temporary Closure & Time to Recovery

Boracay is a small island in the central Philippines known for its resorts and beaches.

Backed by palm trees, bars and restaurants, it is a hub for water sports.

Aside from the panoramic views over the island, its underwater is a world of its own coral reefs and shipwrecks that become home to a diverse marine life.

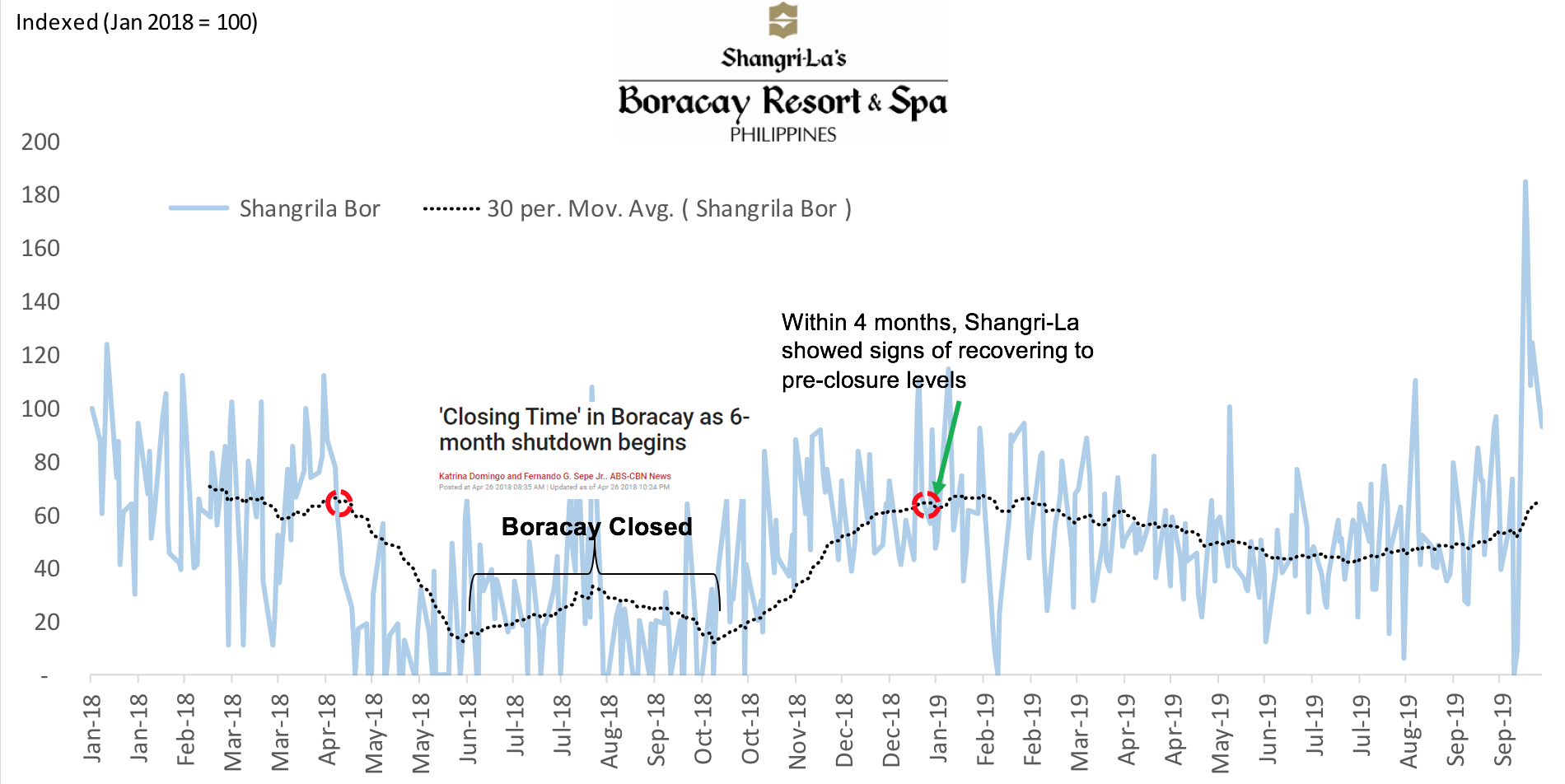

Using GO, you’ll be able to view the impact from the Shangri-La’s Boracay Resort temporary closure and recovery in tourist activity.

The Shangri-La Boracay Resorts & Spa is one of the Philippines island’s prime attractions. Seen here is the dramatic drop in foot-traffic at the resort during a closure and ramp-up thereafter, recovering to pre-closure levels four months after reopening.

Thailand — Mall Comparisons by Day of Week

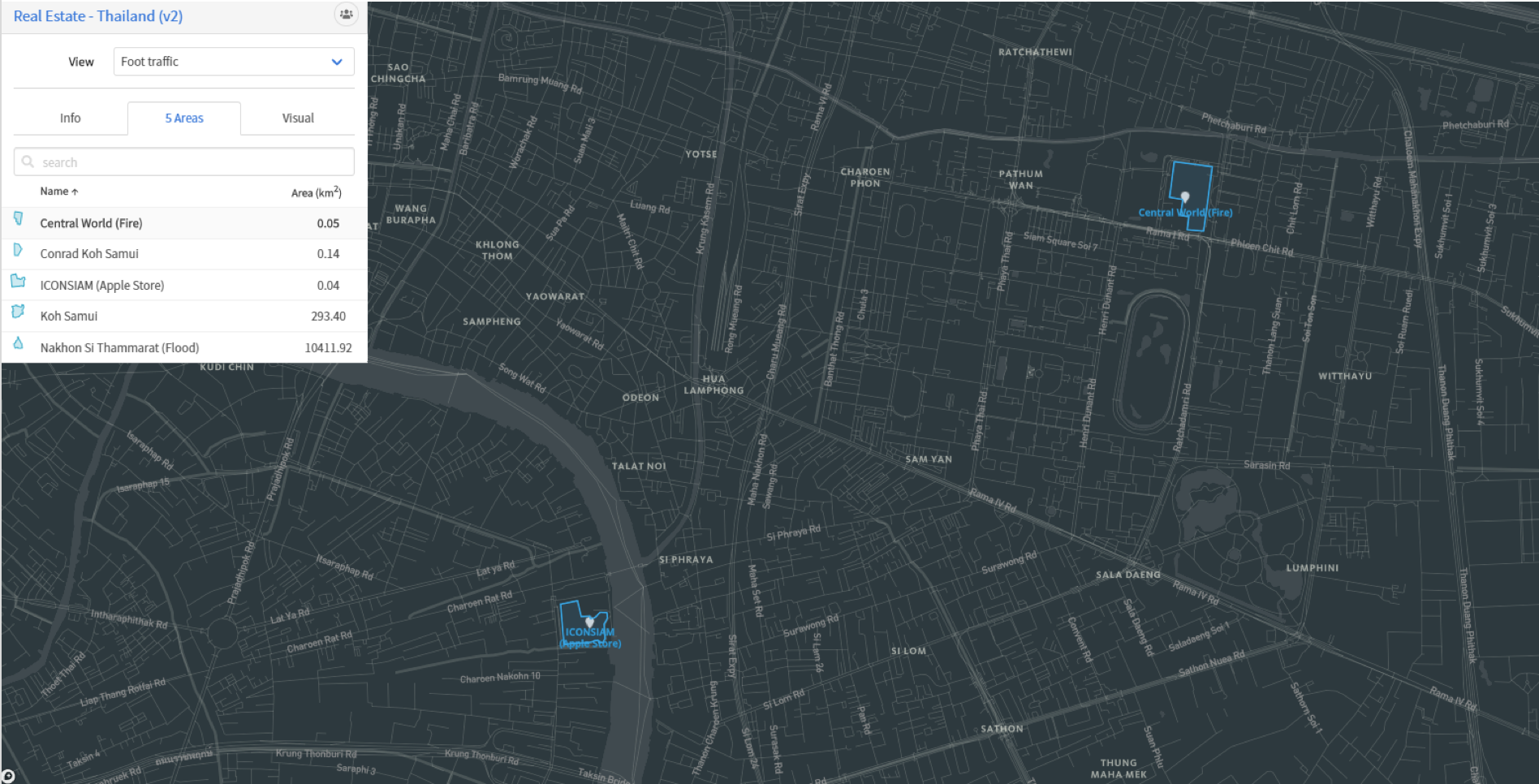

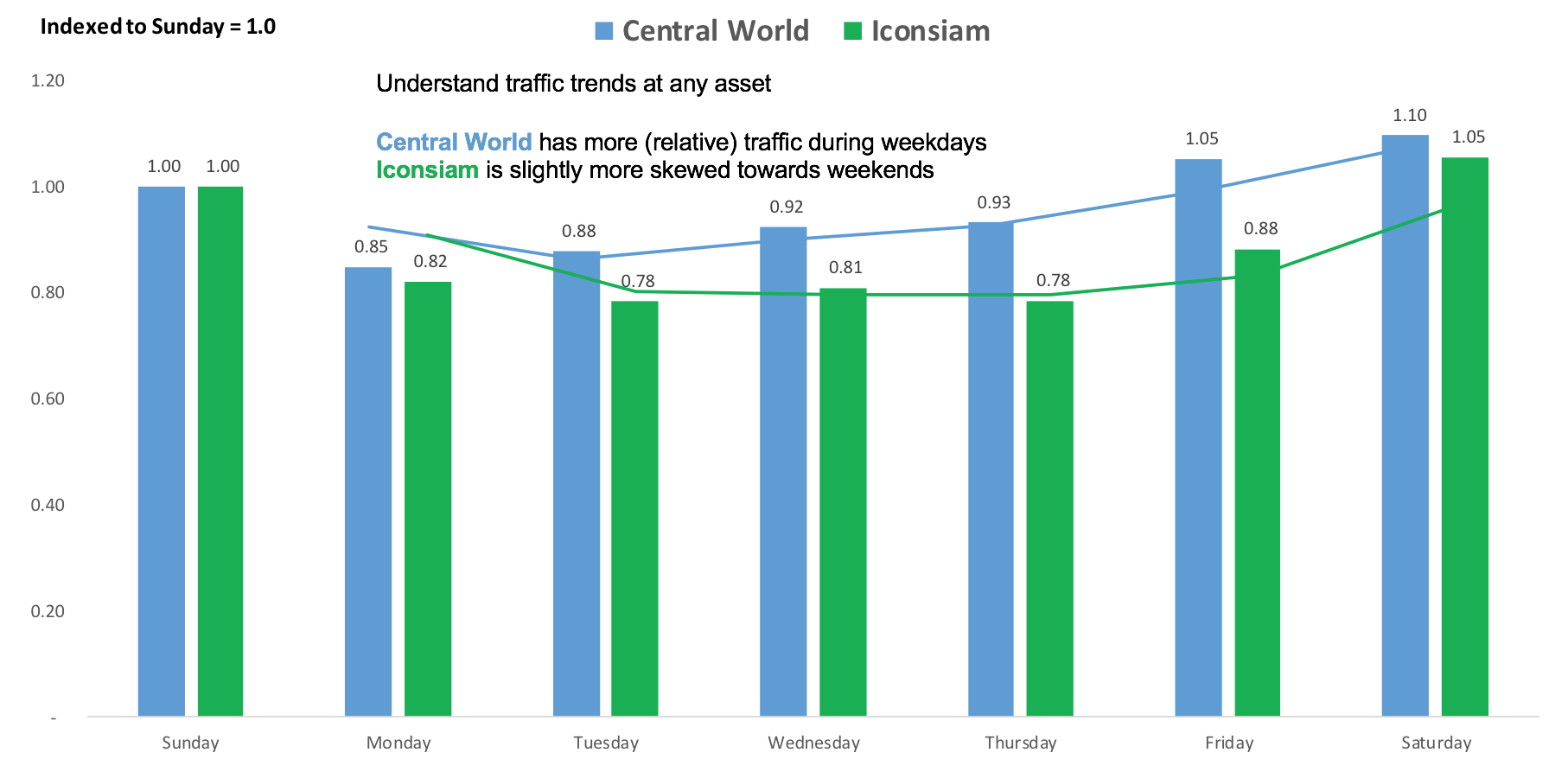

Understanding traffic trends—throughout the week, or during the day—is important for site selection and retailing. Using GO, we compared two major malls, IconSiam and Central World.

At IconSiam, one can clearly see that traffic is dominant on weekends, meanwhile, Central World sees a much more consistent traffic flow throughout the week, which can impact site selection decisions of luxury brands versus traditional retailers, grocery chains, and or other potential tenants.

Understanding traffic trends is key to any commercial asset.

Bangkok’s Central World, a mall that carries everyday retail needs has more relative traffic during weekdays.

IconSiam, home to Apple’s latest retail design store, has crowds slightly more skewed towards weekends.

Indonesia: Market Share Analytics

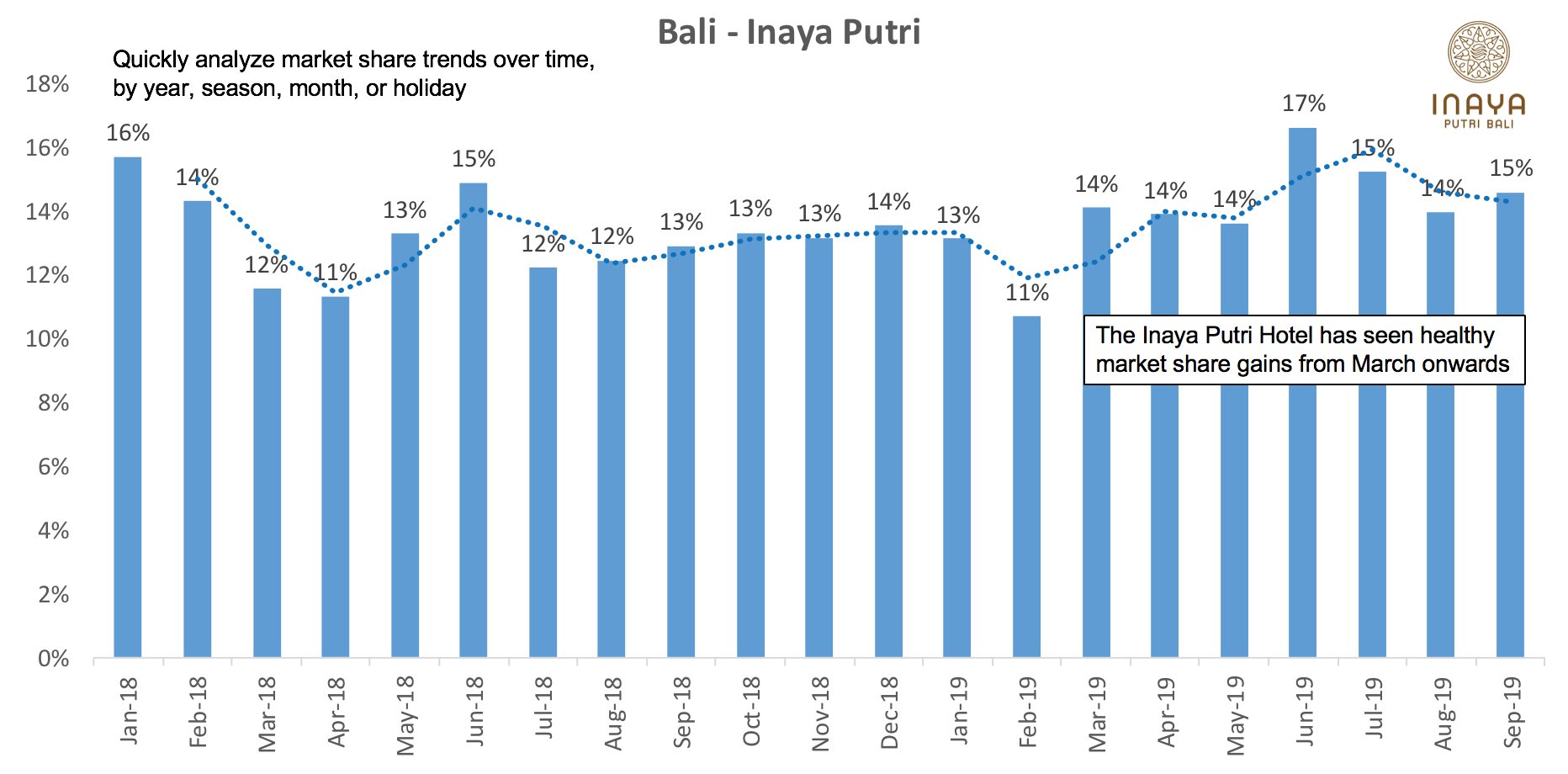

GO allows users to quickly analyze the assets that they’re interested in — for example, the analysis of leading resorts in Bali — including Club Med, Sofitel, Bali Nusa Dua, The Westin, The Laguna, Melia, the Grand Hyatt, Inaya Putri, and Ayodha only took a couple of minutes.

After choosing which assets to analyze, it was easy and quick to analyze which hotels saw more/less traffic share over time; in this example we can see that the Inaya Putri hotel has been gaining market share since March 2019 onwards — which can be impactful for advertisers, pricing decisions, and more.

Orbital Insight GO allows users to create quick, accurate, and efficient real estate analytics data to monitor real estate portfolios within hours.

For more information on gaining location-based insights using GO, please reach out to support@orbitalinsight.com