- Orbital Insight Blog

- Samsung Pyeongtaek: Tracking Semiconductor Manufacturing in Real-Time

Blog

Samsung Pyeongtaek: Tracking Semiconductor Manufacturing in Real-Time

For those unfamiliar with Orbital Insight GO, our self-service geospatial platform, users have access to multiple sources of geospatial data — including millions of satellite images and IoT devices — to develop real-time analytics exactly where and when they want in the world.

This use case will focus on applying daily geolocation data to understand work shifts at Samsung’s Pyeongtaek wafer fabrication facility in South Korea, specifically:

- Detecting the start and ramp-up of work shifts in the new Phase 1 fab before Samsung’s official press release.

- Patterns indicating curtailment of production as NAND prices fell in 2018.

Background

Samsung Electronics is one of the world’s largest semiconductor manufacturers. Samsung’s capacity expansion plans are centered around the Pyeongtaek campus, which broke ground in 2015, involving multiple phases and fabrication lines. Projected capital expenditure on Pyeongtaek is expected to reach $30 Billion, making it the world’s most expensive semiconductor plant.

The plant introduces large additional capacity into the DRAM and NAND markets, which are highly sensitive even to small changes in demand and supply — making production monitoring critical for investors and industry competitors such as Micron, SK Hynix, and Toshiba.

The Phase 1 (“P1”) fab began production in mid-2017, primarily making NAND and some DRAM. Phase 2 (“P2”) is currently under construction and with plans to begin production, primarily DRAM, around March 2020.

Data Creation

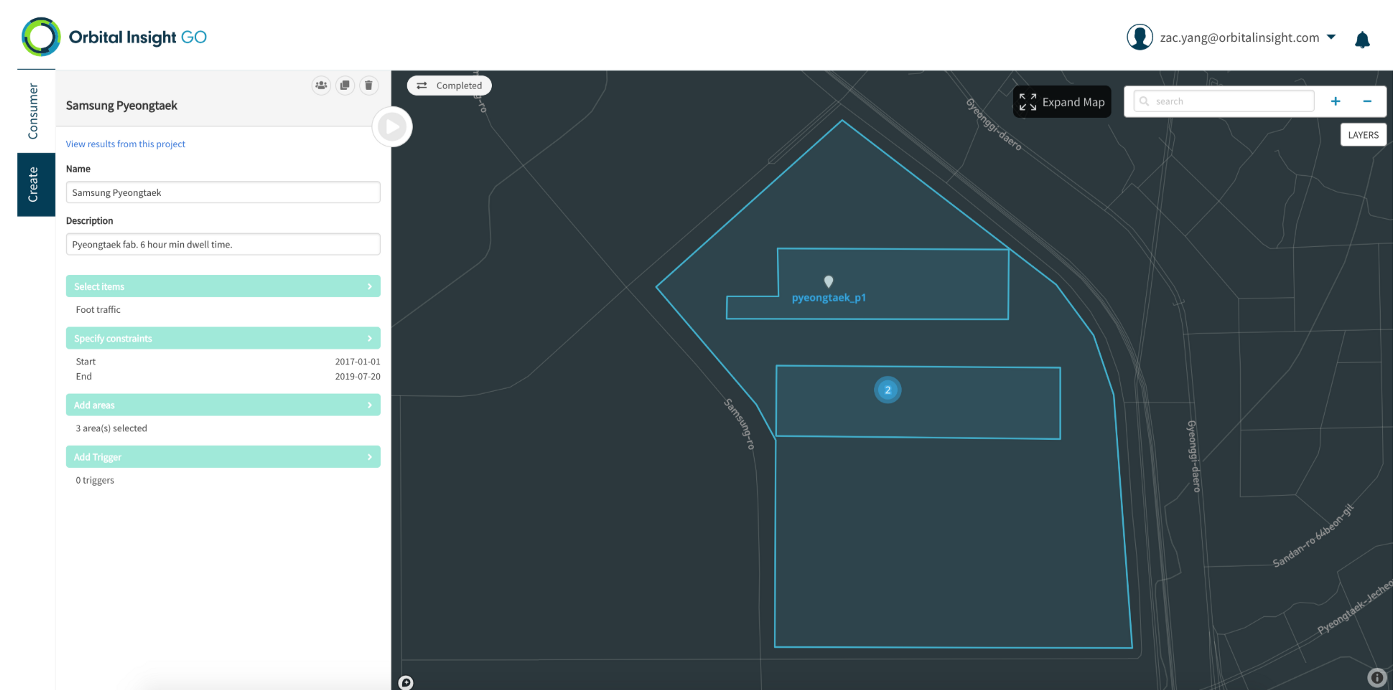

Orbital Insight customers can draw or upload their areas of interest (AOIs) directly in the GO platform. Figure 1 shows the marked polygons for the entire Pyeongtaek campus with sub-AOIs for the P1 and P2 fabs.

Choosing “foot traffic” from a list of algorithms, GO will analyze the AOIs during your custom time period (we chose 2017 to present). You can also apply custom data science, showing results for traffic based on dwell-time to reduce noise in the results. All that’s left to do is hit “Run” and the platform analyzes raw data to produce a time-series of structured data for your analysis.

Pull in the Data

Results can be viewed directly in GO, downloaded as CSV files, or accessed via API.

Ramp Up at P1

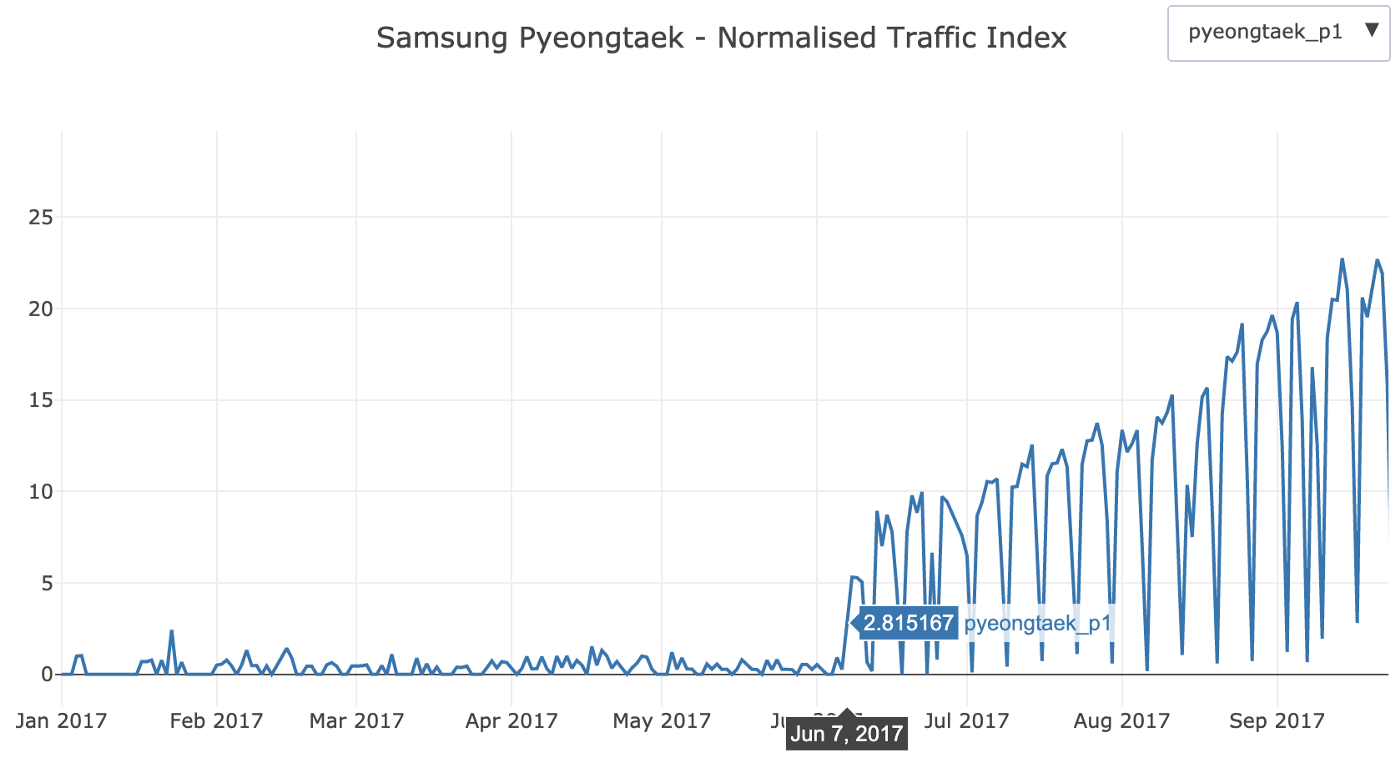

The data output reports normalized traffic on a daily basis. Looking at P1 (Figure 2), you can immediately see the start of work shifts at the plant beginning on June 7, 2017 — a month ahead of Samsung’s official announcement of mass production at Pyeongtaek on July 4th, 2017.

By monitoring the P1 workforce trends using GO, an analyst would know that the plant had begun production operations, quantified a ramp-up in production, and observed the seasonality in weekday and weekend shifts.

Detecting Anomalies: Downtime Shifts

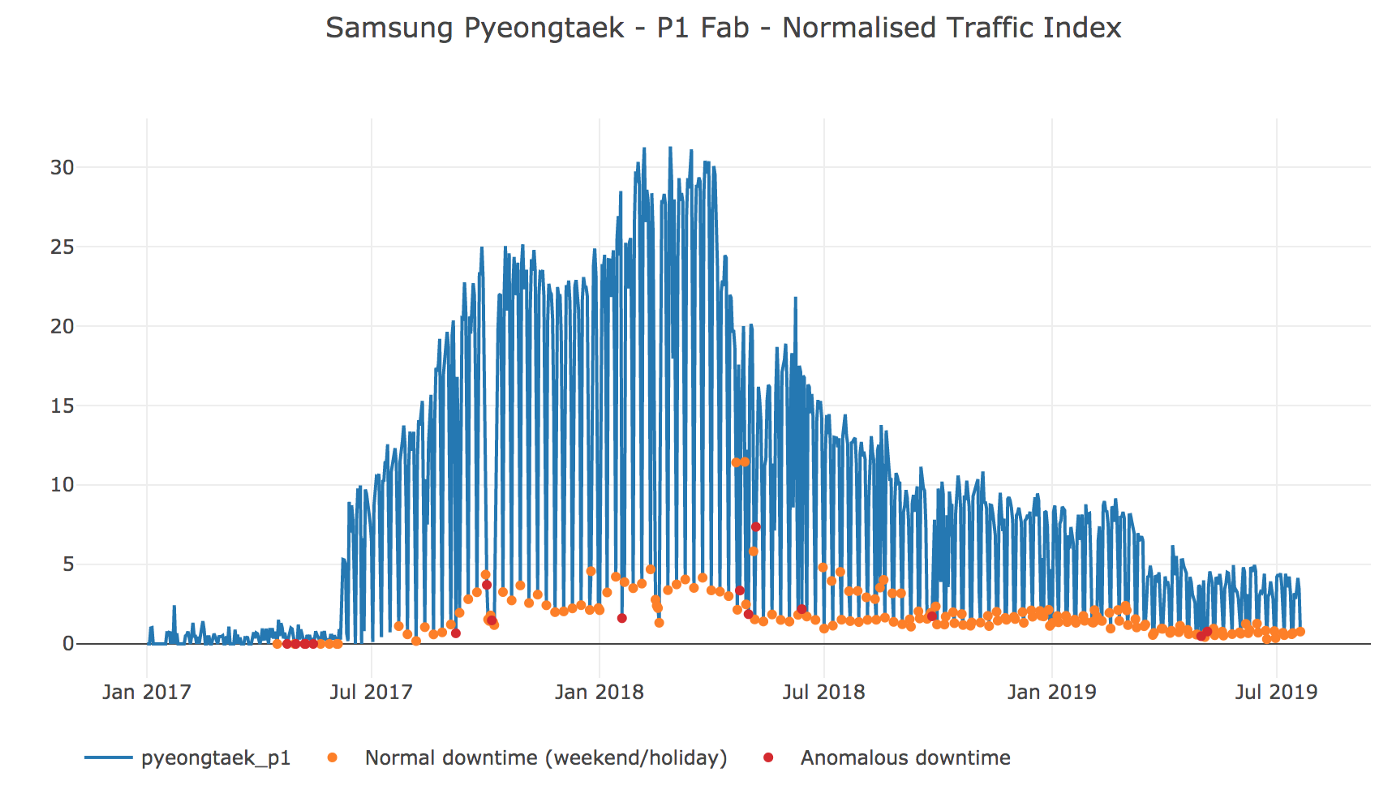

A GO user can conduct deeper analyses by applying algorithms that create baseline workforce trends and detect anomalies. A simple example is looking at days that are one standard deviation greater than the 60-day mean (Figure 3).

Figure 3 visually reveals a series of downtime shifts, many of which are visibly apparent, such as the long Korean holidays of Chuseok (mid-autumn festival; September/October) and Korean Lunar New Year (February).

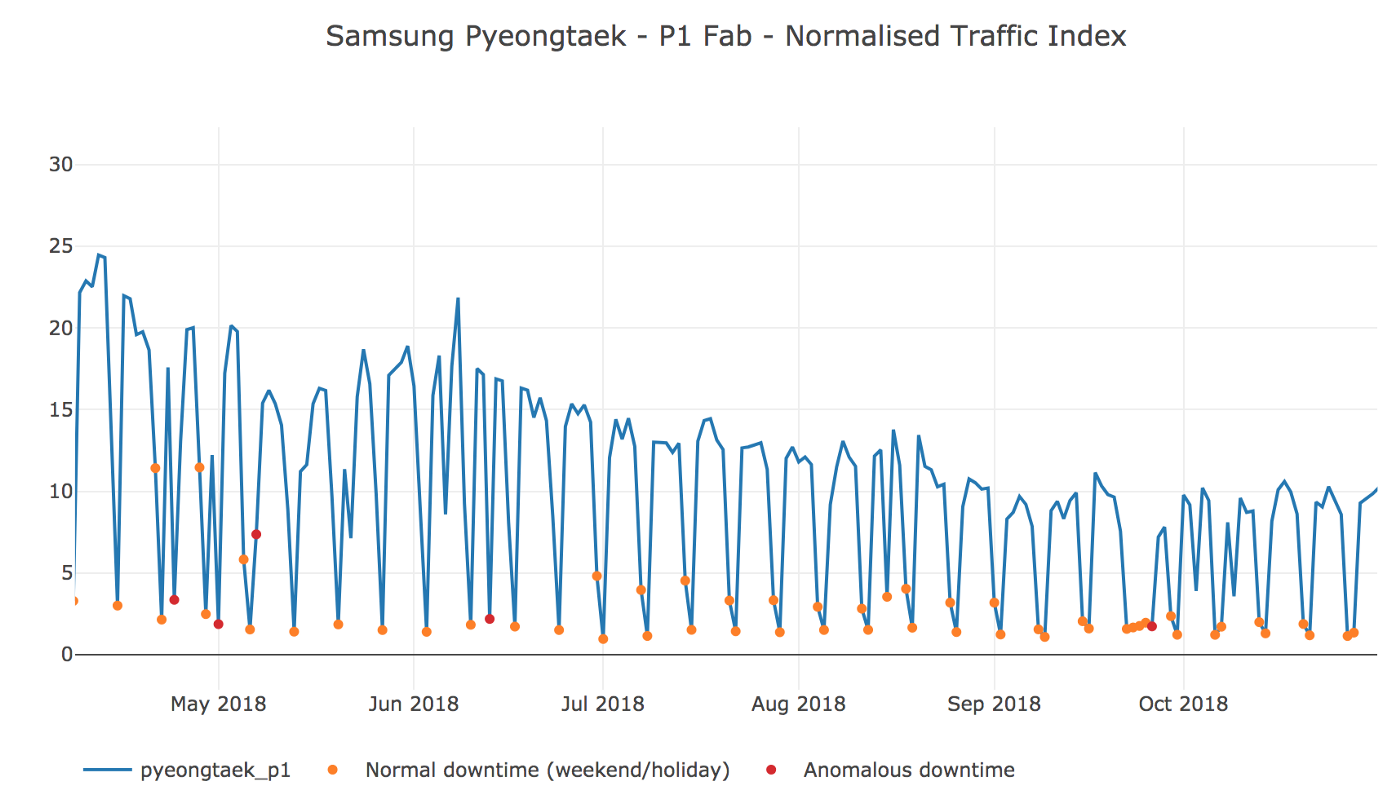

A closer inspection of weekends and public holidays reveals that starting July 2018, P1 moves from a 6 day to a 5 day work week, ending full work shifts on Saturdays (Figure 4).

The table below summarizes the total quarterly downtime versus working days, taking into account public holidays and weekends. From 3Q18 onwards, we observe a clear change from a 6-day to a 5-day working week.

Market Validation

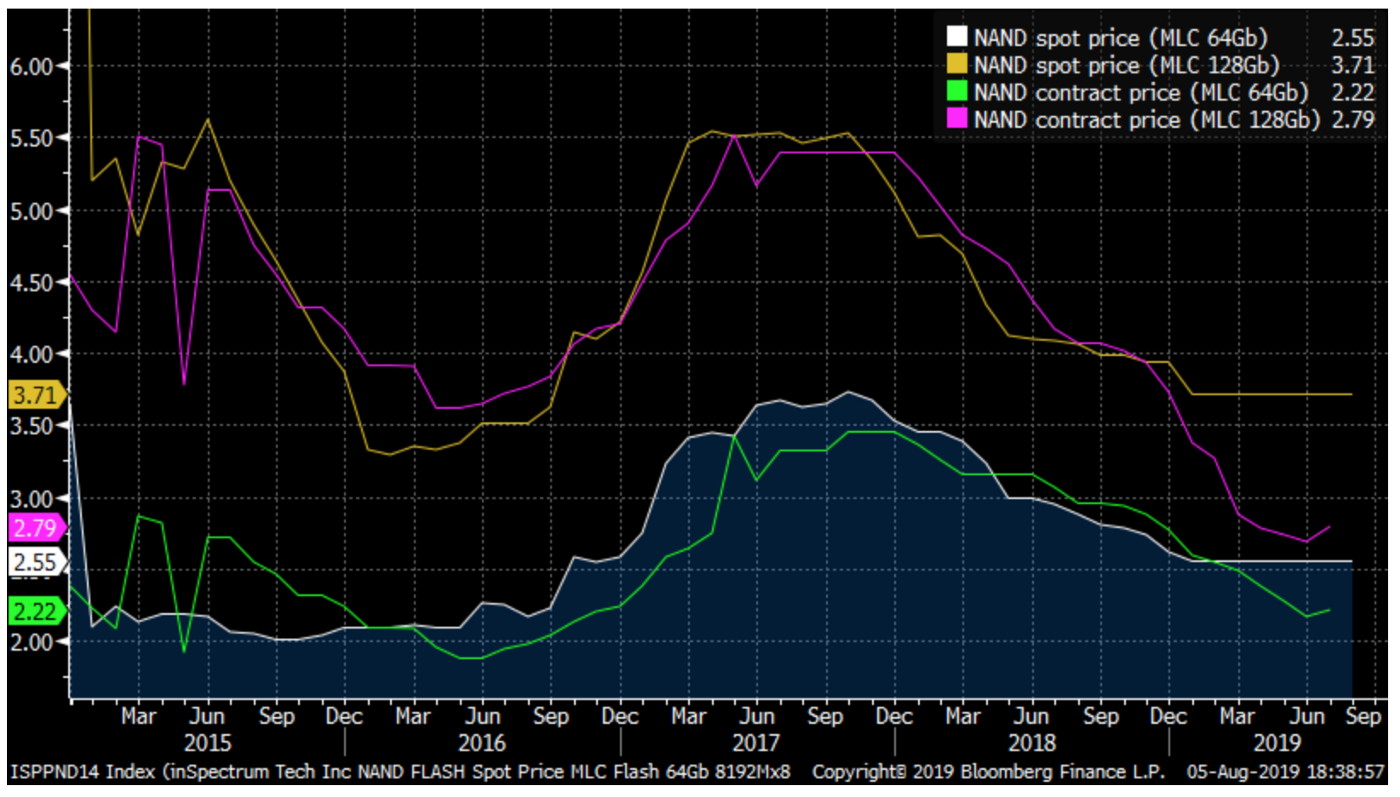

Samsung’s mass production of NAND semiconductors increased market supply, contributing to the cyclical price decline in late 2017 (Figure 5).

Additionally, 3rd party reports confirmed on September 20, 2018 that Samsung was curtailing production growth in 2018 and 2019. Orbital Insight’s anomaly detection detected the switch to 5 day work weeks as early as July 2018.

“Samsung Electronics Co. is planning to curtail growth in memory chip output next year to keep supplies tight amid an expected slowing in demand, according to people briefed on the matter.

The move would help maintain or drive up semiconductor prices, the people said, asking not to be identified discussing the plan.Samsung now expects bit growth of less than 20 percent for dynamic random-access memory and a rise of 30 percent for Nand flash, the people said. Samsung said earlier this year it expected increases of 20 percent for DRAM and 40 percent for Nand in 2018.”

Source: Bloomberg 20 Sept 2018

What’s Next?

GO provides an empirical methodology into tracking manufacturing trends at scale. While this use case focused on Samsung’s Pyeongtaek P1 fab, the same methodology can answer a series of related questions with objective, transparent, and timely data.

Pyeongtaek P2

As stated earlier, Pyeongtaek P2 is expected to begin volume production of DRAM around March 2020. GO users will be the first to track the plant coming online and mass production, receiving a daily pulse of additional supply as it hits the market.

Tracking the Global Semiconductor Market

By monitoring more AOIs, GO Users can now track the world’s semiconductor production and answer:

- Are other chipmakers also showing similar supply discipline?

- When will other facilities under construction at SK Hynix and Toshiba ramp-up & begin volume production?

- Will there be disruptions/shutdowns at key chipmaking facilities?