- Orbital Insight Blog

- Why Transparency and Visibility Are Critical In Supply Chain

Blog

Why Transparency and Visibility Are Critical In Supply Chain

Increased supply chain visibility can build resilient operations, mitigate risk, create better environmental practices, and more

Did you think supply chain disruptions, semiconductor chip shortages, and home appliance stockouts were a thing of the past? The Covid-19 pandemic was a watershed event that exposed global supply chains’ vulnerability. Nevertheless, many supply chain pundits were optimistic about the countermeasures and expected the supplies to ease as production resumed to full capacity.

And now, history is repeating itself in China as the country reels from a new wave of Covid-19 outbreaks. The curbs from the Zero Covid policy have paralyzed factories and transportation networks. Production activity in Shenzhen, Dongguan, and Changchun has come to a halt. The ports are experiencing congestion, with about 30% of the world’s container ships waiting at Chinese ports. Shanghai has been under lockdown for over a month as authorities struggle to counter the COVID surge. And the delays are getting worse at the Port of Shanghai, the world’s largest port. Below is a visualization that shows the increase in the number of vessels from May 2017 to May 2022 based on AIS data using the Orbital Insight platform.

This visualization compares the number of cargo and tanker vessels waiting at the Port of Shanghai each year, from May 2017 to May 2022, based on AIS data on the Orbital Insight platform.

According to the latest RBC Capital Markets Digital Intelligence Strategy Research:

- Ships awaiting berth at the Port of Shanghai tally 344 currently, reflecting an increase of 34% over the past month

- Transit from Chinese warehouses to US warehouses currently takes 74 days longer than usual - this route used to take only 37 days in total

- To Europe, ships from China are showing up 4 days late, on average, catalyzing an empty container shortage for ships wanting to move goods from Europe to the US East Coast

Both domestically and abroad, manufacturers are anxious about the economic impact as in-transit inventory is stuck in a supply chain mess. China shipped a whopping $3.36 Trillion in goods in 2021; the latest supply chain crisis could lead to months of chaos in Asia, Europe, and the Americas, potentially more challenging than the last year. So what can companies with significant China exposure do? How can they respond to make their supply chains more resilient, robust, and responsive?

The Solution: End-to-End Supply Chain Visibility

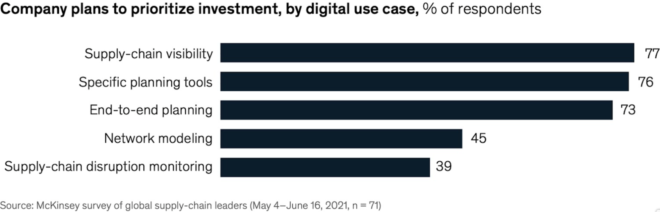

Initiatives such as reshoring, regional supply chains, and alternative manufacturing hubs are all on the table but are part of a long-term strategy, and implementation will take time. However, gaining deep visibility into your supply chain may help in the short term. A recent McKinsey survey showed that global supply chain leaders have prioritized investment to improve visibility across their multi-tier supply chains.

Research suggests that supply chain transparency can boost business value. MIT researchers found that increasing visibility into suppliers' practices can enhance your ability to monitor and improve suppliers’ environmental/social practices and create new business opportunities. Providing increased visibility into the social responsibility practices of their supply chains strengthens customers’ trust in a company resulting in revenue benefits.

With the complexity of today’s global supply chains, visibility has become even more critical. Supply chain leaders ought to understand anomalies, outages, and disruptions at their suppliers and suppliers' suppliers. It is possible to go beyond your supply chain network and include competitors' supply chain networks with the right tools. Alternative data, third-party data, and open-source intelligence (OSINT) can reveal insights in near real-time to allow efficient and cost-effective business decisions.

Take the case of the fertilizer industry and its impact on global food supplies. The agriculture and food industry has borne the brunt of the Ukraine war. Russia and Ukraine together export 28% of fertilizers made from nitrogen, phosphorus, and potassium. The war and the sanctions have disrupted fertilizer shipments sending fertilizer prices skyrocketing. Grain prices continue to rise, and experts predict a global shortage of food supply. Here is an analysis of maritime vessels stuck at Ukrainian ports - Odessa, and others showing the trapped vessels in ports from the Russian invasion.

Orbital Insight's Traceability algorithm was used to visualize vessels moving to and from ports over a three-day period based on AIS transmissions in March 2022

Geospatial Analytics and Location Intelligence

Geospatial analytics and location intelligence solutions can help you to increase supply chain visibility, enhance traceability, and improve operational efficiency. By combining multiple sources of geospatial data - satellite imagery, AIS, and ad tech data, an AI-powered geospatial platform can illuminate supply chains, monitor daily activity levels, perform anomaly detection and reduce disruption risk.

Solutions such as Site Intelligence, Sustainable Sourcing, and Supply Chain Intelligence help you to:

- Analyze human activity

- Track shipments, dwell time, and delays

- Monitor supply chains

- Map out tier-2, tier-3, and tier-4 suppliers

- Visualize all suppliers in the ecosystem, and

- Assess risks, and answer critical questions about risk

Identifying critical suppliers and visualizing interdependencies to mitigate risk is vital since you can make key operational decisions in time based on pricing and supply data.

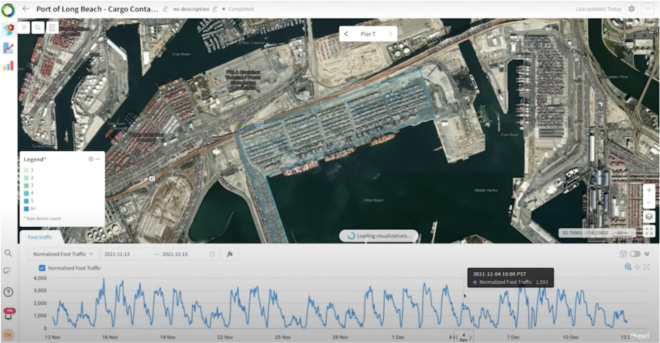

Insights from real-time data enable analysts to visualize delivery patterns, spot warning signs from suppliers struggling to keep up with demand and make alternate plans. This image shows analysis of foot traffic at the Port of Los Angeles, where operational efficiency has eroded over recent months.

Queries such as which ports have delays and where to reroute goods to improve utilization based on real-time data can save you months. Insights from real-time data will empower supply chain managers to identify ships that take longer to arrive and make alternate plans. These solutions enable analysts to analyze delivery patterns, spot warning signs from suppliers struggling to keep up with demand and check their financial health to identify alternatives quickly. In addition, the best supply chain intelligence solutions facilitate collaboration between procurement, sales & operations, and demand planning teams. Last but not least, these solutions provide competitive insights, improve sourcing and build long-term strategic differentiation.

Consumer packaged goods, chemical, and automotive companies must leverage location intelligence for enhanced supply chain visibility and traceability. Novel location-based supply chain intelligence solutions can detect changes in the supplier ecosystem, uncover hidden patterns indiscernible to the naked eye, and deliver competitive insights at scale. The technology can also prevent deforestation, promote responsible sourcing, and contribute toward sustainability goals. The consumer goods giant Unilever is an excellent example of using geospatial intelligence to provide transparency of its commodity supply chains from farm to mill and link this with deforestation data.

Are you curious to learn more about AI-powered geospatial analytics and how it can help you promote sustainability and improve supply chain visibility and resiliency? Learn more about Supply Chain Intelligence here.