- Orbital Insight Blog

- Bon-Ton Is Back, But Some REITs It Left Are Writhing

Blog

Bon-Ton Is Back, But Some REITs It Left Are Writhing

The iconic retailer has a new life online while previous hosts Washington Prime and CBL struggle with debt.

It survived The Great Depression. It survived World War II.

But it couldn’t survive Digital Disruption – not in its original form, at least.

As Bon-Ton, the iconic departmental store that shut all its 260 outlets in eight months this year, rebuilds as an online retailer, the inevitable message coming around is: America’s terminally-ill shopping brands can ditch their monumentally expensive brick-and-mortar shells to begin new, less stressful – and hopefully, more profitable – lives on the same Internet that’s threatening them now.

But Wait, There’s Another Horror Story! One That Starts With An “S….”

November is spookfest time and as this story was in the works, Sears gave us an early Halloween scare by filing for bankruptcy after building a mountainous $5 billion debt. Billionaire chairman Edward Lampert, who’s been keeping the 125-year-old retailer on life support with his own hedge fund money, pulled the plug after eight unprofitable years. Sears merged with K-Mart in 2005 to become a 3,500-store behemoth.There are just 700 of those left, and half could disappear if its Chapter 11 filing works. If not, then it’ll be Chapter 7: Lock, stock and barrel under the gavel. A horror story indeed for later telling. Now, back to Bon-Ton.

Validation Of Amazon?

In its simplest read, the digital resurrection of Bon-Ton will come across as a validation of the e-commerce model of Amazon and other retail luminaries in cyberspace whose scale, convenience and pricing are crushing at remarkable speed the customer loyalty, traffic and business built over decades by neighborhood malls. Bon-Ton’s new president, Jordan Voloshin of CSC Generation, says he brought the company back online because of legacy customers, many who told him they were “truly saddened by the thought of losing their beloved brand.” “Few companies are lucky to have customers who are this invested in its success,” he says.

Some ARE Fighting Back … And Well

For sure, physical retailers aren't rolling over and playing dead amid the online invasion. Publicly-traded A-grade mall chains such as Simon Property Group and Macerich, as well as private REITs like Pyramid Management and Cafaro Company, keep shoppers and crowds thronging to their best properties with carefully-thought out themes and tenants that more or less compensate for other weak spots within their portfolios.

And the fallen could return too.

Bon-Ton says if its sale-by-click of home goods, electronics, apparels and cosmetics starts ramping, it might reopen some limited-hour stores. That would truly defy the “Retail Apocalypse” narrative where comebacks are rare, if not impossible.

While a back-in-the-mall Bon-Ton will certainly be wondrous for the soul of American retail, for now it's important to see what's in its wake -- and unearth the red flags pointing to others in the trade.

Writings Were On The Wall

At 120, Bon-Ton wasn’t the oldest departmental store – the aforementioned Sears was 125 and Macy’s turned 160 this year. Its super-long existence, however, meant it had forged countless business relationships over the years, none more important than with the mall operators who trusted it as anchor to build hundreds of thousands of square feet of space, now amounting to tens of millions of dollars in lost leases. Even before the physical uprooting of Bon-Ton, those who followed the portfolios of Washington Prime Group (WPG) and CBL & Associates would have known of the ominous writings on the wall of the two chains that counted on the celebrated brand as anchor in more than a dozen properties each that they ran. Our newest data suggest that with Bon-Ton’s departure, these REITs are writhing from a further drop in vehicles numbers and foot-traffic at those malls.

What We Do And Why

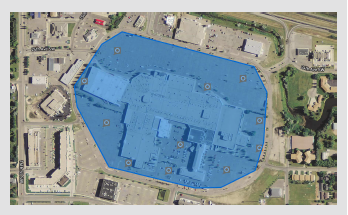

Before we reveal what we know, here’s a brief of what we do and why: Orbital Insight’s geospatial analytics with satellite imagery and cell phone location data allows us to have a persistent view on more than 3,300 U.S. malls and shopping centers. Swooping in, we can have a macro view of traffic acceleration and deceleration within a geo-fenced area of interest (AOI). From there, we have the ability to do micro study of foot-traffic in buildings within the periphery, via cell phone pings collected from GPS, WiFi, and bluetooth signals generated from the location settings of mobile apps operating in the geo-fenced AOI. These technologies allow us to compile a comprehensive picture of REITs, mall grades and their geographies for clients seeking such tradable signals to make investments and other intelligent business decisions.

Prologue: Too Much, Too Soon

When 15 Bon-Tons close at a time, that’s 15 stores of 50,000 sq-ft each going down simultaneously. Suddenly, the mall owner is faced with the onerous question of whether to try and find an anchor who’d take all of that space or break it down to boxes of 30,000, 20,000 and 17,000 sq ft spread among three tenants -- a dilution game that could be tricky and costly. Interestingly, both WPG & CBL had an equal 25% exposure to Bon-Ton on their portfolios. Aside from its eponymous stores, Bon-Ton also operated the Herberger’s, Bergner’s, Boston Stores, Carson’s, Elder-Beerman and Younkers labels. Some of these outlets were in C-Grade and D-Grade malls. Those lower-quality malls will probably have harder time finding new anchors.

What Our Data Tells You

At Orbital, our Device Count indexing for foot-traffic rationalizes numbers to show relative changes in traffic, rather than absolute measurements. All our DC Indexes start at a 100-count and divide each day’s progress at a location with the first day's traffic there.

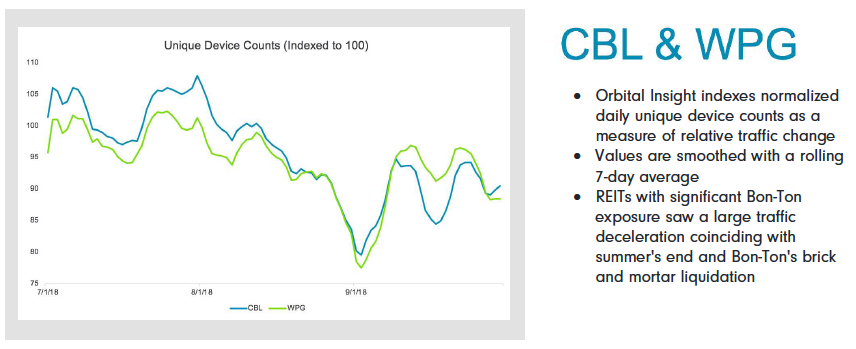

With the WPG and CBL properties that had Bon-Ton as anchor, the DC Index reading stood at above 100 in early July, then dipped to approximately 80% of baseline traffic right after the store closures on August 31.

Since then, there's been a recovery, not quite to the baseline, but stabilizing at around 90%.

WPG, CBL And Their Debt

To better understand what WPG and CBL are up against, we need to look at their debt -- and they aren't pretty. WPG’s total debt to total equity was at 323.10 in the second quarter, while CBL’s was at 371.13. For comparison, A-grade mall operator Macerich (MAC) had a DE reading of 140.44 for the same quarter. WPG’s debt troubles were on display when it failed in its bid to buy Bon-Ton when the retailer first announced bankruptcy. But between the two REITs, CBL probably has bigger problems. As of August, Chattanooga, Tennessee-based CBL was in danger of breaching its debt covenants, according to independent analysts. At its Acadiana Mall in L.A.’s Lafayette, CBL wrote down the $110 milion asset by 38% to $67.3 million after being unable to refinance its mortgage. There are more of such write-downs: Cary Towne Center (62% down to $32 million), Janesville Mall (48% down to $18 million) and Hickory Point Mall (64% down to $14 million).

More Creative Thinking Needed At These REITs

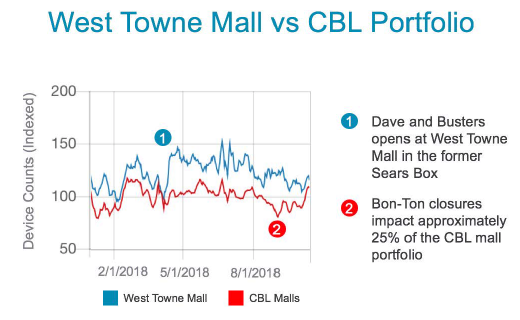

In terms of coming up with winning mall concepts and strategies -- the aforementioned recipe that’s driving throngs of crowds to the top-tier outlets -- both WPG and CBL haven’t shown the creativity required to reinvent themselves. Neither have much focus on leisure and entertainment -- a lost opportunity, considering the immense popularity of lifestyle-themed malls such as Pyramid Palisades with the millennials of today, who are the most powerful consumers of this generation. But when they did put on their thinking cap, the results were impressive. At the West Towne Mall in Madison, Wisconsin, CBL witnessed a traffic spike by bringing lifestyle-oriented tenants, including Dave & Busters and Total Wine & More, into a previous Sears box that it broke into three.

A Silver Lining For Some; “Sear”-ing Pain For Rest

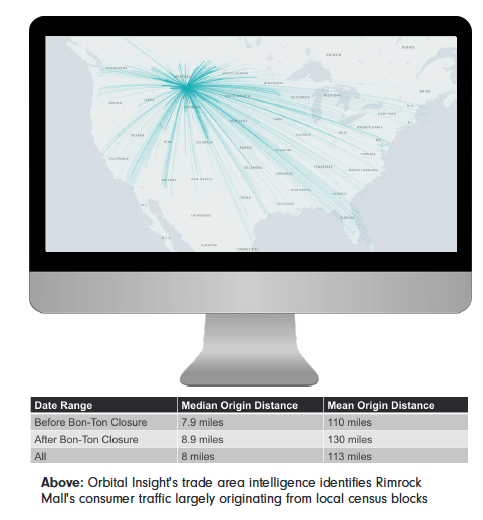

Higher class mall portfolios, including Simon, GGP and MAC, will use Bon-Ton’s exit as an opportunity to backfill their properties with more profitable anchors. Rimrock Mall, Montana’s most successful shopping center run by Starwood Property Trust, saw a major traffic spike in the run-up to the Aug. 31 closing of Bon-Ton. A constituent of the CMBX.7 Index, a derivative of 25 retail-heavy Commercial Mortgage Backed Securities originated in 2013, Rimrock claims a customer draw in the radius of 150 miles. Orbital’s Device Count Indexing at the Montana mall also showed a traffic spike leading up to Bon-Ton’s closure. The difference between Rimrock and the WPG/CBL properties that housed Bon-Ton was the Montana mall’s relative outperformance after Aug. 31. WPG and CBL, meanwhile, had bigger holes to fill. Bon-Ton’s departure had coincided with Sears’ initial plan to close 78 stores this year (yes, that was before the bankruptcy) and some of them sat on the portfolios of WPG and CBL too. Unlike Bon-Ton’s share of 16 and 15 stores, respectively, on CBL’s and WPG’s exposure list, Sears’ will affect the two REITs much less, with just six and three stores each in their inventory. What's key though is the psychological impact the double whammy of these closures have on investors, more than the actual numbers.

CMBX Issues Go Hyper

Trading in Commercial Mortgage-Backed Securities’ X.7 series (CMBX.7) tied to Bon-Ton exploded in April right after word of its physical shuttering. Listings by independent analysts show noteworthy loans with exposure to Bon-Ton include the $146.5 million Southdale Center (split between MSBAM 2013-C10 & MSBAM 2013-C11) and the $138.7 million Park City Center (MSC 2011-C3). Another CMBS asset worth watching is the $74.6 million loan behind the Wyoming Valley Mall in Wilkes-Barre, Pennsylvania (GSMS 2014-GC18) as the shopping center lost Bon-Ton (17.1% of the net rentable area) and will lose Sears next (12.9%).

Conclusion: No Healthy Market By Any Means

In a vibrant market, a failing tenant finally leaving provides an opportunity for the mall to reposition itself more successfully in the market. But in the current toxic retail environment, it means more pain for the landlord. Typically, large departmental stores hold mall owners hostage, leveraging co-tenancy agreements. This means small tenants have a legal obligation in their rental agreement to remain in the store as long as they benefit from theoretical large store traffic. But it also means that once an anchor leaves, small tenants have the right to leave too.

Epilogue: Curse or Boon?

It’s not known yet whether the closure of Bon-Ton will be good for CBL and WPG over the longer-term.

What we do know is, for now, their investors see little upside and have shown their displeasure with the stock of the two REITs.

As of Oct 14 -- six weeks after the Bon-Ton closure -- CBL's stock was down 39% on the year, with a compounded drop of 65% since they began trading in 1993. WPG’s shares were off 28% from the end of 2017, and 68% down from their 2014 launch.

Yes, those REITs are writhing, and we’re watching their daily traffic to see if they float or flounder.