- Orbital Insight Blog

- GM Strikes and Supply Chain Monitoring

Blog

GM Strikes and Supply Chain Monitoring

The United Auto Workers’ (UAW) strike against General Motors continues. Pressure mounts on GM to make a deal as their stock plummets by more than 10% and vehicle production has ceased at their major manufacturing plant sites.

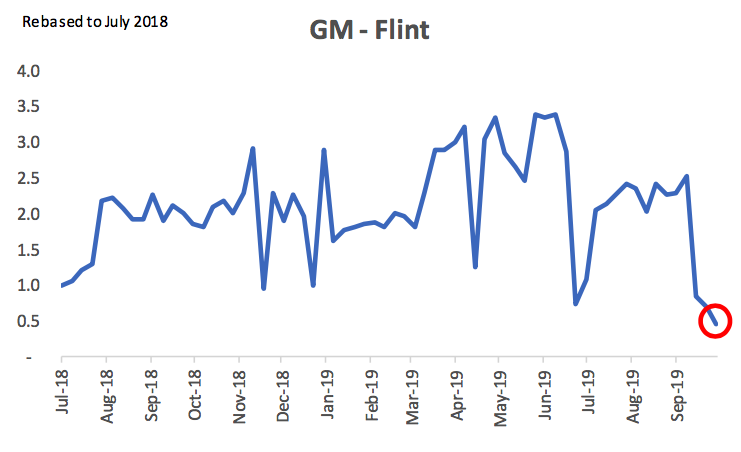

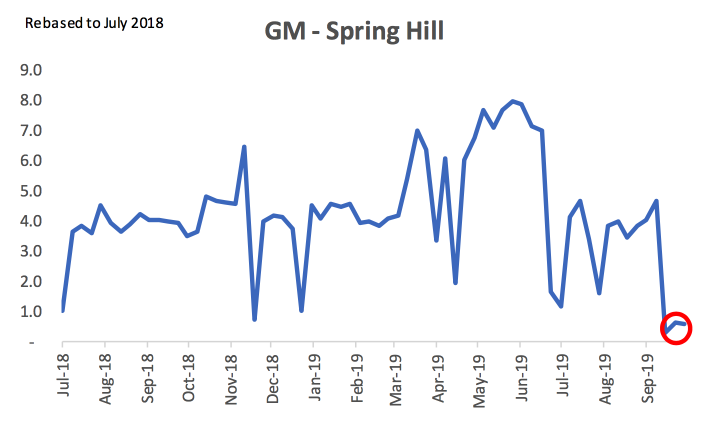

Orbital Insight looked into the impact of these disruptions — using the GO platform and its geolocation algorithm — to determine the number of employees at GM’s main facilities. And as suspected, foot traffic was at an all-time low (numbers you’d only see at Christmas). In a matter of minutes, we were also able to identify the timeline of the impact and length of those disruptions.

Orbital Insight GO detects an all-time low in foot traffic at the GM Flint plant.

Orbital Insight GO foot traffic algorithms detect holiday-level workforce trends at GM Spring Hill.[/caption]

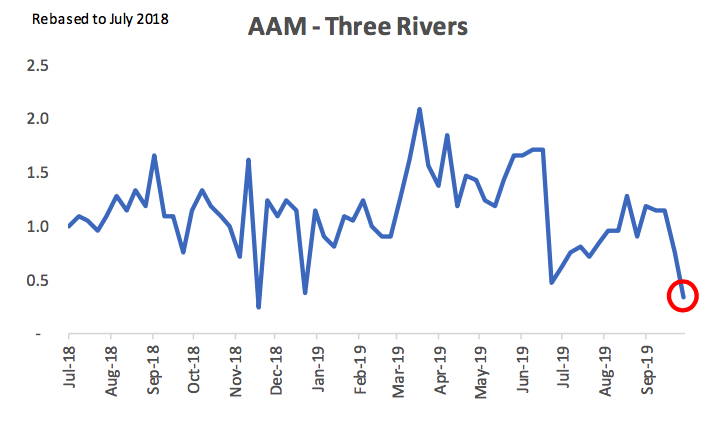

Remarkably, even GM’s partners, like American Axle, were massively impacted — since they had to lay off their workers as the demand slowed for making parts for GM cars and trucks. You can see at their plant at Three Rivers, how the same downward trend in foot traffic applies.

Orbital Insight GO quantifies downstream supply chain layoffs at American Axle.

This leads us to believe that the strikes have had a massive ripple effect across GM’s supply chain, from parts manufacturers, service and repair, shipment companies, affecting a large number of jobs — exactly the opposite of UAW’s intention — to increase fare wages and keep jobs in America.

While GM has enough inventory to wait out the strike for several months, dragging out the contract negotiations may take an unnecessary toll on the economy and US car companies’ global competitiveness. In the meantime, we’ll be monitoring how long it will take American Axle and other important partners to recover should the strike diminish.