- Orbital Insight Blog

- Our Predictions on PropTech for 2020

Blog

Our Predictions on PropTech for 2020

For anyone who has attended ICSC, the retail real estate trade show where 30,000 brokers, landlords, vendors, tenants, and lenders meet around the theme of deal-making, you’ll know that it can be an exercise in time and energy management. In fact, Ten-X even wrote a blog post on the topic of how to survive the show.

For anyone who has attended ICSC, the retail real estate trade show where 30,000 brokers, landlords, vendors, tenants, and lenders meet around the theme of deal-making, you’ll know that it can be an exercise in time and energy management. In fact, Ten-X even wrote a blog post on the topic of how to survive the show.

As a tech participant in this year’s ICSC NYC Deal Making conference, our biggest takeaway was the increasing importance of innovation in Commercial Real Estate. The Tech Connect area, which was once relegated to a tucked-away corner, is now the first thing you see upon entering the Expo floor. And real estate companies are now dedicating larger portions of their scarce deal-making time to explore innovative new technologies.

While its no secret that the real estate sector is undergoing its big data revolution — evident from the existence of conference series like CRETech — real-time objective data on commercial properties is on its way to “must-have” status in 2020.

Above: "PropTech" is one of the top software category keywords on Exploding Topics.

It is clear that relying on intuition no longer has the competitive edge it once had. We compiled the feedback from dozens of firms at ICSC Tech Connect around why brokers, landlords, developers, and REITs and compiled our top predictions on the PropTech market for 2020:

Companies Will Look for Partners with Long-Term Potential

Today’s PropTech companies are usually small startups that are rapidly developing software to hypothesize their customer’s pain points and work toward solving them each development sprint.

While the early adopters of PropTech were willing to explore various data sources of varying breadth and fidelity in exchange for first access, the expectations for 2020 will fundamentally change. Real estate tech adopters will be unwilling to compromise on data accuracy. They will expect faster access to data in packaging that allows them to explore their specific area of interest (e.g. properties, entrances, street corners, markets) — which only a few technology firms are positioned to provide.

That’s why we at Orbital Insight employ a “One-Stop-Shop” approach to location data, bringing data sources like satellite imagery, anonymized cell phone geolocation, connected devices, aerial, etc all under one roof so our customers can spend more time generating insights rather than evaluating the newest dataset on the market. Rather than just resell or aggregate data, Orbital Insight’s team of data scientists and engineers continuously clean and normalize raw datasets to make them customer-ready for insight generation and analysis.

This is possible through superior Silicon Valley financing (led by Sequoia Capital, Google Ventures, Goldman Sachs, and others) and product innovation, servicing the Global 2000, leading financial institutions, and the U.S. government for years.

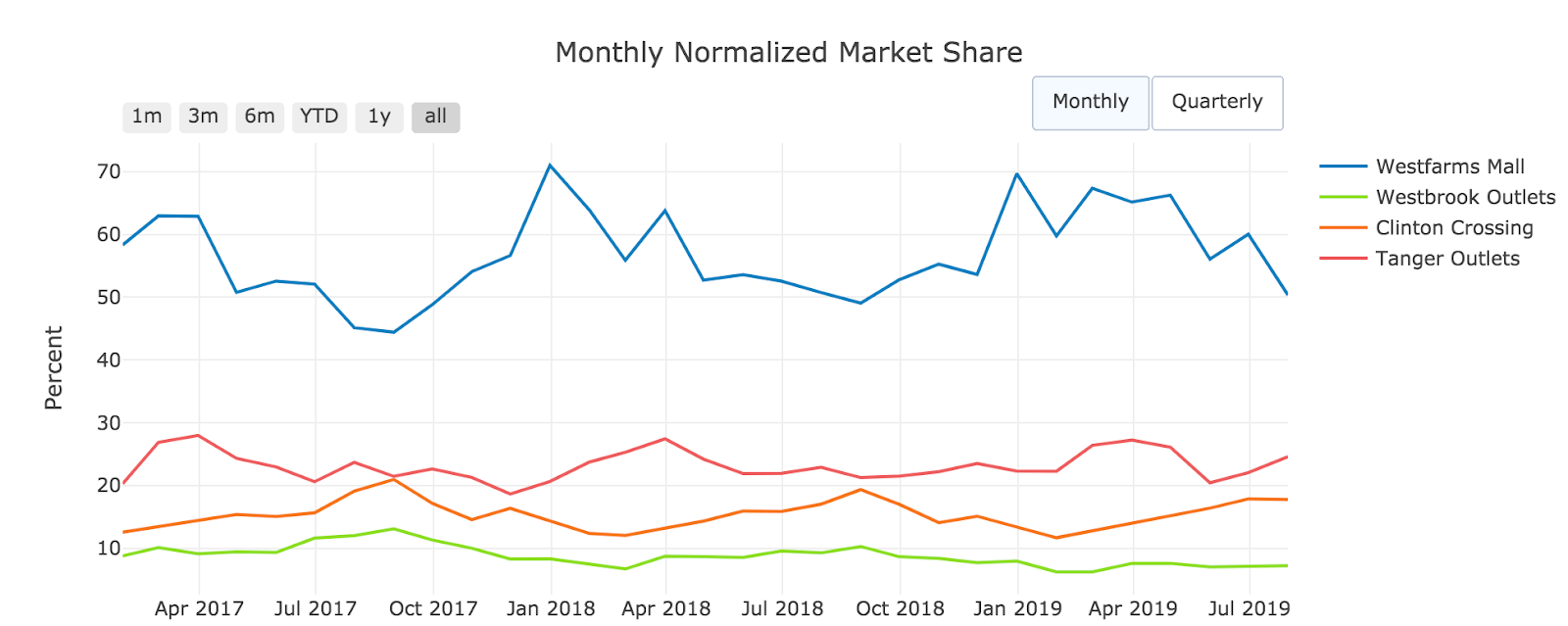

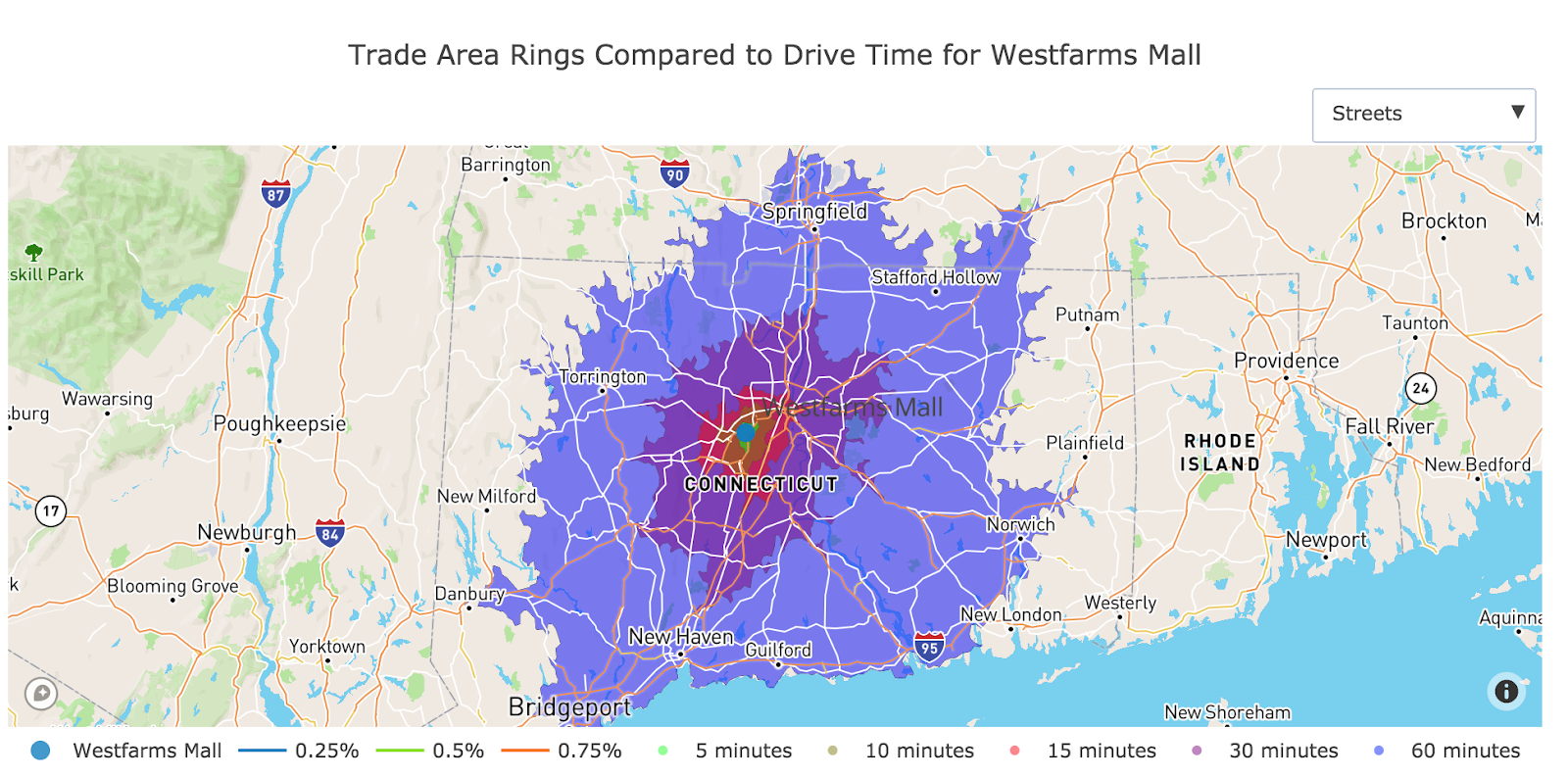

Customers choose Orbital Insight because we focus on data accuracy, unlocking actionable insights such as cross-traffic, trade areas, market share, and demographics. One client, a QSR franchise operator, shared that their experience with our trade area data “unlocked a new market beyond what they had previously hypothesized”, revealing that customers were traveling much further from suburbs, and confirmed afterward from onsite interviews.

Above: Orbital Insight ingests, interprets, and analyzes multiple geospatial data sources as opposed to single source alternatives.

By partnering with the market leader in geospatial analytics, our customers invest in a long-term partnership with the world’s most capitalized location intelligence firm providing the newest data sources with the highest degree of accuracy — whether you’re looking at your portfolio, comps, a street corner, or the entire MSA.

Values-Driven Business Will Become a Priority

Commercial Real Estate stakeholders are members of their community and support values-driven business.

As a core value of Orbital Insight, we seek to use AI for good and fundamentally believe that technology has the capability to positively impact people and the planet. That’s why it’s imperative that any data source we use rigorously adheres to our ethical standards in addition to industry standards and privacy legislation such as GDPR.

Orbital Insight’s mission of understanding economic and societal trends at scale forces us to look at the big picture, analyzing global patterns in retail traffic, poverty, supply chains, and more. While cell phone geolocation data has been historically used by marketing agencies and e-commerce firms to serve personalized advertisements, Orbital Insight’s business intelligence applications don’t need personally identifiable information, and as a result, we don’t purchase it or infer it from combined datasets.

End-users of Orbital Insight see aggregated trends providing insightful real estate analytics that both help investors and respect consumer privacy, such as understanding overall property visitation, or trade area.

Above: Orbital Insight’s property analyses report data in an aggregated and anonymized format, yielding depth of insight and respecting consumer privacy.

The Industry Will Need Empirical Data, not Disruption

As an observer of commercial real estate trends, we remain dispassionately objective. Our mission is to provide our clients with best-in-class empirical data for fully informed decision making whether its to optimally select retail locations, redevelop assets, or make an acquisition decision.

We don’t seek to become or replace brokers, whose combined years of real estate experience is necessary for deal flow in the market. As one client mentioned, “geospatial data is most important to understand how trade areas are accurately defined, how customers behave, and potential competitive pressures.” While some SaaS technology seek to disrupt markets, our approach is broker-friendly where all stakeholders have access to flexible insights on demand.

Above: Orbital Insight helps all commercial real estate stakeholders with objective, transparent, and timely data.

Conclusion

While intuition has served as a competitive differentiator in the past, artificial intelligence can support CRE domain expertise and scale it many multiple ways (e.g. faster decision making, superior diligence, filling informational gaps).

As you evaluate location intelligence partners in 2020, our findings support partnering for long-term success, supporting values-driven business, and data vendors rooted in objectivity. As the ecosystem becomes increasingly crowded, Orbital Insight offers an option you can grow with and has a track record of reputable investors, large capitalization, experience, and technological breadth.

We’ve also made a promise for our clients in 2020 to incorporate new novel data sources and faster access to insight with fewer clicks.

We hope to see you at ICSC REcon!