- Orbital Insight Blog

- Pyramid: Putting the Crown Back on America's Suburbia Malls

Blog

Pyramid: Putting the Crown Back on America's Suburbia Malls

The King of Toys is gone. But the King of West Nyack is still around, conducting itself with regal aplomb.

We're talking about the death of Toys 'R' Us. And the resurgence of the Palisades Mall, Pyramid Management Group's crown jewel in West Nyack, New York – a 2.2-million-square-foot behemoth that on record gets 24 million visits a year. The U.S. mall with the largest gross leasable area, the Simon Group-owned King of Prussia – yes, that's really what it's called – is even more mind-boggling at 2.9 million sq ft. But at 22 million annual visits, this place in Philadelphia falls just shy of the Palisades' pull.

Beating The Apocalypse

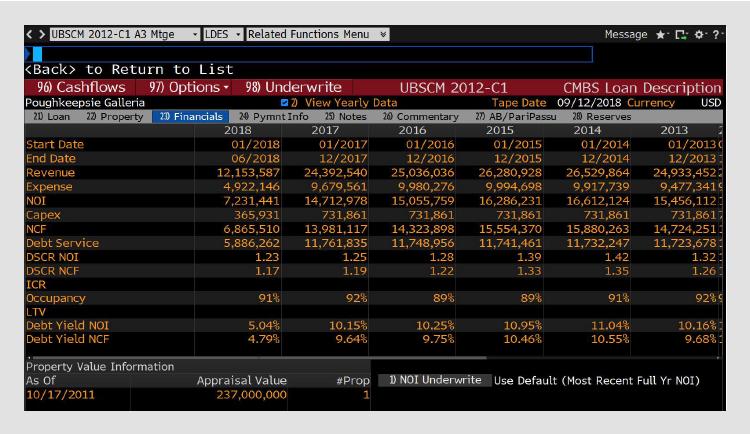

With the "Retail Apocalypse" claiming one iconic victim after another since the financial crisis, some private realtors like Pyramid are showing publicly-traded REITs – many with massive, ailing assets – that suburbia malls can not only stay alive but also thrive. To be sure, Pyramid has its weak links too. Bon-Ton's national closure of more than 250 stores this year has hurt traffic at The Shops of Ithaca owned by Pyramid, which counted on the century-old department store as an anchor at the Lansing, New York mall. Pyramid's Poughkeepsie Galleria – financed by an $80.7 million mortgage securitized in a 2012 UBS Commercial Mortgage series that was the second-largest C1 loan then – has seen significant traffic decline in the last few weeks. From a retail traffic of 3.5% of CMBX Series 6's observed on Sept 7, it dipped below 3% by Sept. 17. Revenue is also down, from $26.3 million in 2014 to $24.4 million in 2017, and appears to have stabilized with $12.2 million in the first half of this year, according to Bloomberg data. Despite such missteps, Pyramid has still hit the goldmine with the Palisades and its success there is shaping up to be a textbook guide for mall management in the 21st century. And the ramping foot traffic in its portfolio indicates a position of strength to remedy those troubled spots.

The Mall & American Life

Since the opening of the first U.S. mall in 1956 – the Southdale Center in Edina, Minnesota – shopping centers have been at the cross-section of American culture and life, morphing into what McKinsey calls "the heart and soul of communities, the foundation of retail economies and a social sanctuary for teenagers everywhere". Even so, the researcher notes that they're now at "a critical inflection point". "The Mall Is Not Dead," adds Coresight Research, saying what's needed is "transformation". With online shopping just a phone tap away, how does one bring the mojo back into shopping malls?

Bringing The "Fun" Back Into Shopping

Orbital Insight's answer is that the "shopping" be left out as much as possible from the "mall". Our insight shows movie theaters, restaurants, game arcades, bowling alleys, skating rinks and other "fun" spots to be the real people magnet in these places, versus apparels and other strictly-shopping stuff that often occupy space more than crowds. Westfield has shown that its $1.4 billion Oculus at the One World Trade Center in New York City can be a place to "Shop, Eat, Drink, Play … All under one magnificent roof" – demonstrating a bold move to blend a mall with not just office towers and a subway hub, but also a memorial. Now, the Palisades is emerging as West Nyack's showpiece for redefined shopping experiences through its lifestyle-fueling mall.

Following The Data

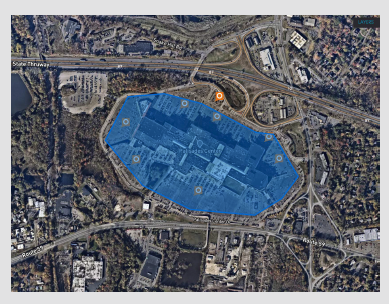

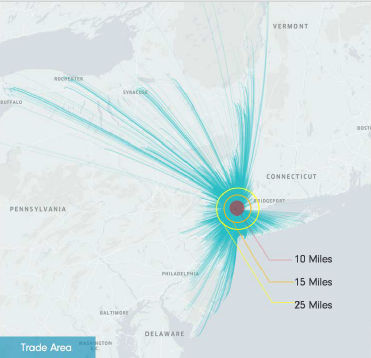

But before we deconstruct the Palisades story, let us walk you through the technologies we use and how they brought our attention to the dynamic traits of this 20-year-old mall. At Orbital, we cover over 3,300 U.S. malls, giving insights into REITs, mall grades and their geographies. We rely on geospatial analytics with satellite imagery to automatically detect cars, as well as cellphone geolocation pings to monitor foot traffic, in places of commercial interest. The feed on foot traffic helps us spot trends as well as anomalies. While there are various tracking technologies in the market for measuring people movement and other economic activity, we're the only combined provider of imagery analytics and ping data to create tradable signals. Once we geofence an area of interest (AOI), using computer vision and machine learning we can see what traffic acceleration and deceleration looks like there, even whether vehicles are stationary or moving. Simultaneously, we obtain cellphone pings through GPS, WiFi, and Bluetooth signals derived from the mobile apps of users in the area.

Finding The "Hottest" Stores

Our geolocation data currently covers 9% of the US population. and we get pings from 20 million daily active users. Depending on a complex list of variables that include battery life, phone settings, and even velocity, we can get up to 1,000 pings a day from each device that enters the geo-fenced area. Simply put, we can see in real-time which malls are drawing crowds and which aren't. We can also drill down to the "hottest" stores and businesses in a location, those that are just getting by and those that may do better to close. These anonymized, aggregated data can be widened to cover week-on-week, month-on-month and year-on-year trends and juxtaposed with that of other locations to draw comparisons, correlations and other conclusions. In the process, we can learn which malls have been growing organically and which have caught up lately by stealing customers from others. This technological walk-through is to reveal the incredible amounts of data we process in a day and how those flows are pushing the boundaries of our cloud software and infrastructure that we have to upgrade constantly.

Now, on to our analysis: While drawing comparisons between private and public REITs, we noticed Palisades topping most of the desired matrix out there, and drilling down further, saw a recent spike in activity there.

Mapping & Diving In

Mapping out to do a deeper dive on the data, we turned to our geolocation census block information to aggregate traffic origination trends towards the mall. In a sample period of three months – June, July and August – we found cars from New York and New Jersey traveling an average distance of 12.06 miles to the Palisades (it must be noted that this represents straight lines of travel, which in practice aren't realistic, so the actual distances are probably a lot more, considering the different routes and turns taken for reaching the mall). And the traffic growth could continue, with the opening of a new stretch on the former Tappan Zee Bridge. The new 3.1-mile span on the rechristened Governor Mario M. Cuomo Bridge now links Rockland, the county for West Nyack, with Westchester, one of New York State's richest counties. Palisades' own website prides the mall for being at the crossroads of nearly 340,000 cars flowing daily along County Road 59 and Interstate 87 and 287, the last of which leads to the now Cuomo Bridge. The bridge itself has historically been an important transit into West Nyack and nearby Nanuet for New Jerseyeans.

Content Planning

It must be noted that the opening of the Rockland-Westchester link on the bridge is a New York State municipality action unrelated to the Palisades. While it could be fueling traffic to the mall, our conclusion is that it's Pyramid's content planning that's paying real dividends for the Palisades. Also, the Sept 8 opening of the bridge link doesn't explain the traffic swell towards the mall captured in the three months prior by our data. While we're tempted to think that summer and other seasonality trends could be reasons for that growth, there's also evidence that the Palisades has pulled back from a low in foot traffic just a year ago – suggesting some serious rethink and work done by Pyramid to draw crowds again to the mall. That's what we're setting to uncover here.

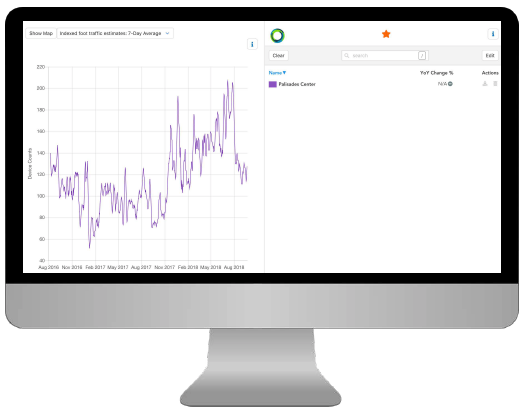

Tracking The Pinging

Over a six-month phase, we compared daily pings captured from unique devices within the Palisades to similar data gathered at the Simon Group-owned Shops at Nanuet, an A-grade mall in what's often regarded as West Nyack's twin city. The first results in October 2017 showed there were 1.7 times more devices beaming at the Palisades than at the Simon mall in Nanuet. In March this year, another test showed the devices spike at the West Nyack location to be 2.7 times more.

Lifestyle Thinking

Palisades' outperformance stats would, of course, be meaningless without breaking down the tenants and activity that's driving those numbers.

The mall has the usual stuffy, retail-heavy names that include Macy's, Bed, Bath & Beyond, BJ's Wholesale Club, Home Depot and Target among them.

But on its website, Palisades talks of featured tenants such as Levity Live (Beyond Funny) Comedy Club & Theatre, immersive game action center 5 Wits, kids playland Billy Beeze, the Get Air Trampoline Park, Lego, AMC movie theatres, sport and adventure labels Adidas and Lucky Strike, and restaurants – a bunch of them – from Cheesecake Factory to Dave & Busters, Chipotle, Red Robin and Chili's. All carefully curated to expound its brand: A lifestyle-first mall.

The theme is further complemented by activities such as Munchkin Mondays, where children can dress up and play. Spanish circus group Circo Hermanos Vazquez is also playing at a huge carpark in the venue all September.

In Google searches, Palisades mentions it has 200 stores but draws particular emphasis to its bowling alley, ice rink, the world's tallest indoor ropes course and 16 sit-down restaurants. "Even those who loathe shopping can find something to draw them here," a caption unmistakably says.

Shopping & No Play Will Keep People Away

Simon's Shops at Nanuet is, meanwhile, anchored by Fairway Market, and also has Macy's as a major tenant, along with Sears. But aside from Regal Cinemas, fun and games are conspicuously missing from its roster of 61 names.

While privately owned malls are generally viewed as lower quality centers in comparison to their publicly owned peers, we're seeing stable traffic trends at Pyramid in a struggling sector. In the first quarter of 2018, the Pyramid portfolio saw 1.32 times greater traffic growth year-on-year compared with US shopping center traffic across the Mid-Atlantic.

The narrative is clear: Rebranding is a must for the rejuvenation of American malls. Pyramid's Palisades has shown us how.

"Long live the King!"

Want to get powerful geospatial analytics for your business and industry? We've deciphered the mystery behind thousands of Teslas found parked in a Californian field; explained how geospatial analytics were providing insights for global oil storage and the tracking of such inventories; and pointed out declines in Walmart store traffic despite in-store upgrades

Write to sales@orbitalinsight.com for more information on how we can help.