- Orbital Insight Blog

- How Big Data Identified Where the Next Lowe’s Should Go

Blog

How Big Data Identified Where the Next Lowe’s Should Go

In short, by using location intelligence paired with market share, trade area, and demographic analyses, we identified these Home Depot locations as ripe for Lowe’s to cannibalize (in order of best opportunity identified by our algorithm):

- 2450 Cumberland Pkwy SE, Atlanta, GA 30339

- 3401 Oakwood Blvd, Hollywood, FL 33020

- 6880 W Bell Rd, Glendale, AZ 85308

- 9969 W Camelback Rd, Phoenix, AZ 85037

- 11305 SW 40th St, Miami, FL 33165

- 875 Lawrenceville-Suwanee Rd, Lawrenceville, GA 30043

- 2300 S University D, Davie, FL, 33324, United States

- 4159 Farm to Market 1960 Rd W, Houston, TX 77068

- 9170 E Talking Stick Way, Scottsdale, AZ 85250

- 5351 Diplomat Cir, Orlando, FL 32810

- 60 SW 12th Ave, Deerfield Beach, FL 33442

- 8555 Home Depot Drive, Irving, TX 75063

- 4403 Millenia Plaza Way, Orlando, FL 32839

- 449 Roberts Ct NW, Kennesaw, GA 30144

For those interested in our methodology, we created a blog post explaining how we arrived at these 14 locations:

Introduction

When two of the biggest brands in a market lock horns, who wins the biggest crowds (and, of course, business)?

Almost everyone knows that differentiation has shifted billions of dollars between rivals such as Coke and Pepsi; Marvel and DC; McD and BK; Ford and GM; Dunkin’ and Starbucks; UPS and FedEx; Nike and Reebok; Airbus and Boeing; Hasbro and Mattel; AT&T and Verizon; and, finally, Apple and Samsung.

Epic marketing wars can be fought and won through the “4 P’s” of Marketing — Price, product, promotion, and place.

This piece will focus on place, and more specifically real estate site selection between Home Depot and Lowes, showing how geospatial data and AI can extract the most value out of each location.

A Lot of Likeness Between Home Depot and Lowe’s

For years, Home Depot and Lowe’s have been the leading home-improvement store names in the U.S.

Despite their fierce battle to be different, both have much in common, in the sense that:

- Both have more 2,000 stores in North America — Home Depot has 2,284 and Lowe’s 2,370

- Both stock a huge inventory of products related to home improvement, including for kitchen and bath.

- Both stores offer same-day delivery, installation services, do-it-yourself workshops, and store credit cards.

… Yet, Their Differences Matter

But for all their likeness, there are important differences between Lowe’s and Home Depot.

Here, we list just two, for historical and market context:

One — Lowe’s was founded in 1946, and Home Depot was established in 1978. This means Lowe’s has been in business for 30 years longer than its rival.

Two — and this is possibly more important than the first — Despite being around for much longer, Lowe’s store sales have historically lagged those at Home Depot. It also does not attract traffic in the scale of its rival.

So, How Can We Improve The Market Situation For Lowe’s?

Using Orbital Insight’s geospatial-driven GO platform has given us powerful insights into the peculiarities of Lowe’s stores versus Home Depot’s, and enabled us to pick 14 store locations that can make a positive difference for Lowe’s foot traffic.

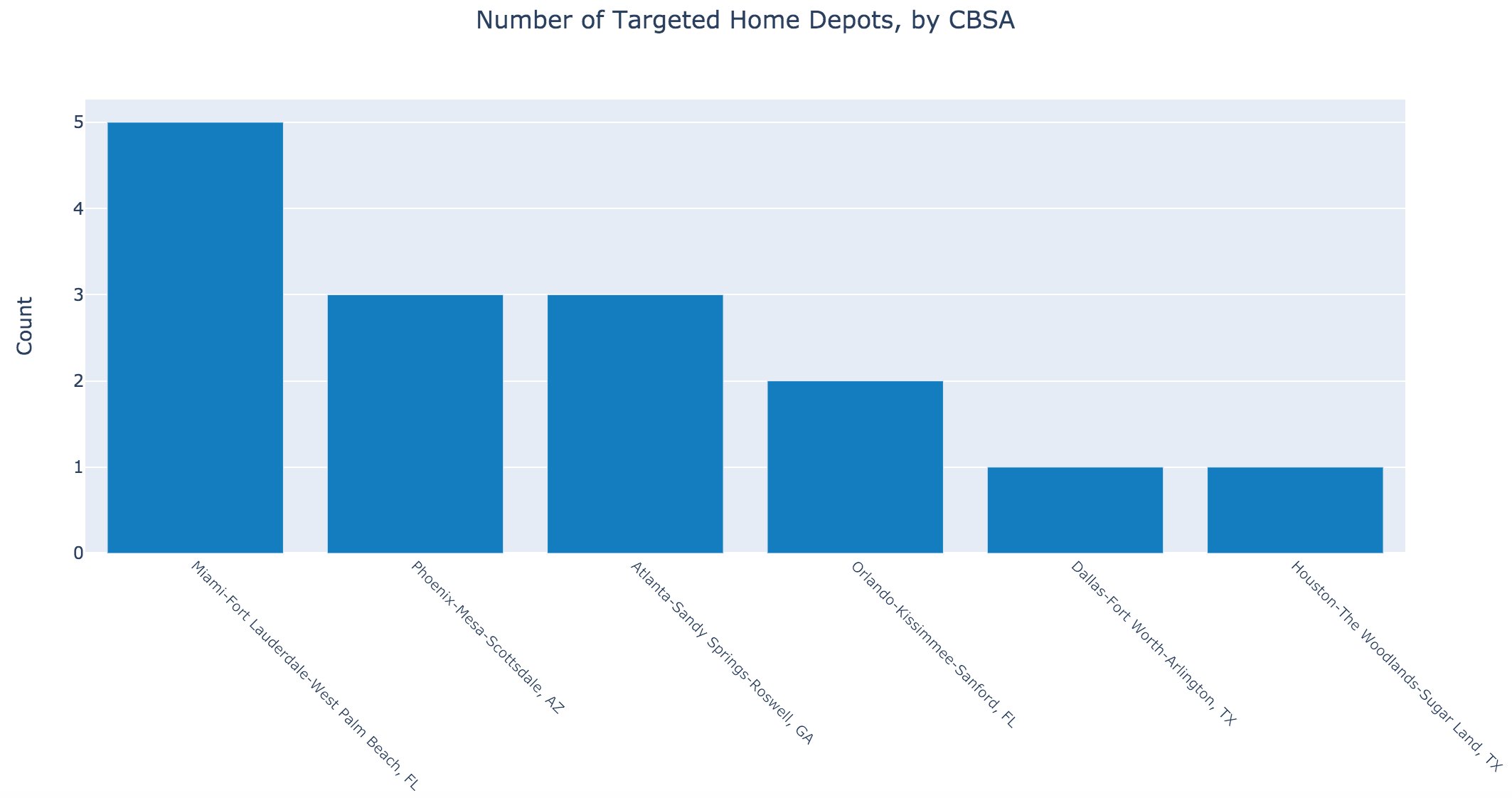

To assist in our search of those locations, GO focused on areas of fastest population growth in the US. A core-based statistical area (CBSA) is a U.S. geographic area defined by the Office of Management and Budget that consists of one or more counties (or equivalents) anchored by an urban center of at least 10,000 people plus adjacent counties that are socioeconomically tied to the urban center by commuting.

Using the CBSA methodology, GO was able to assess both Home Depot and Lowes trade areas, and determine the areas where Lowe’s has a lower market share. We then use existing Lowe’s stores to build a demographic profile to filter down the list of potential Home Depots to compete with to best match Lowe’s current profile for site selection.

Our research showed that Lowe’s actually lags Home Depot in 18 out of 20 fastest-growing CBSAs, with the largest exception being Charlotte, which is Lowe’s home city. The most significant gap based on the number of stores is located in the Miami-Fort Lauderdale region.

As aforementioned, we found 14 potential sites that Lowe’s should consider for future expansion.

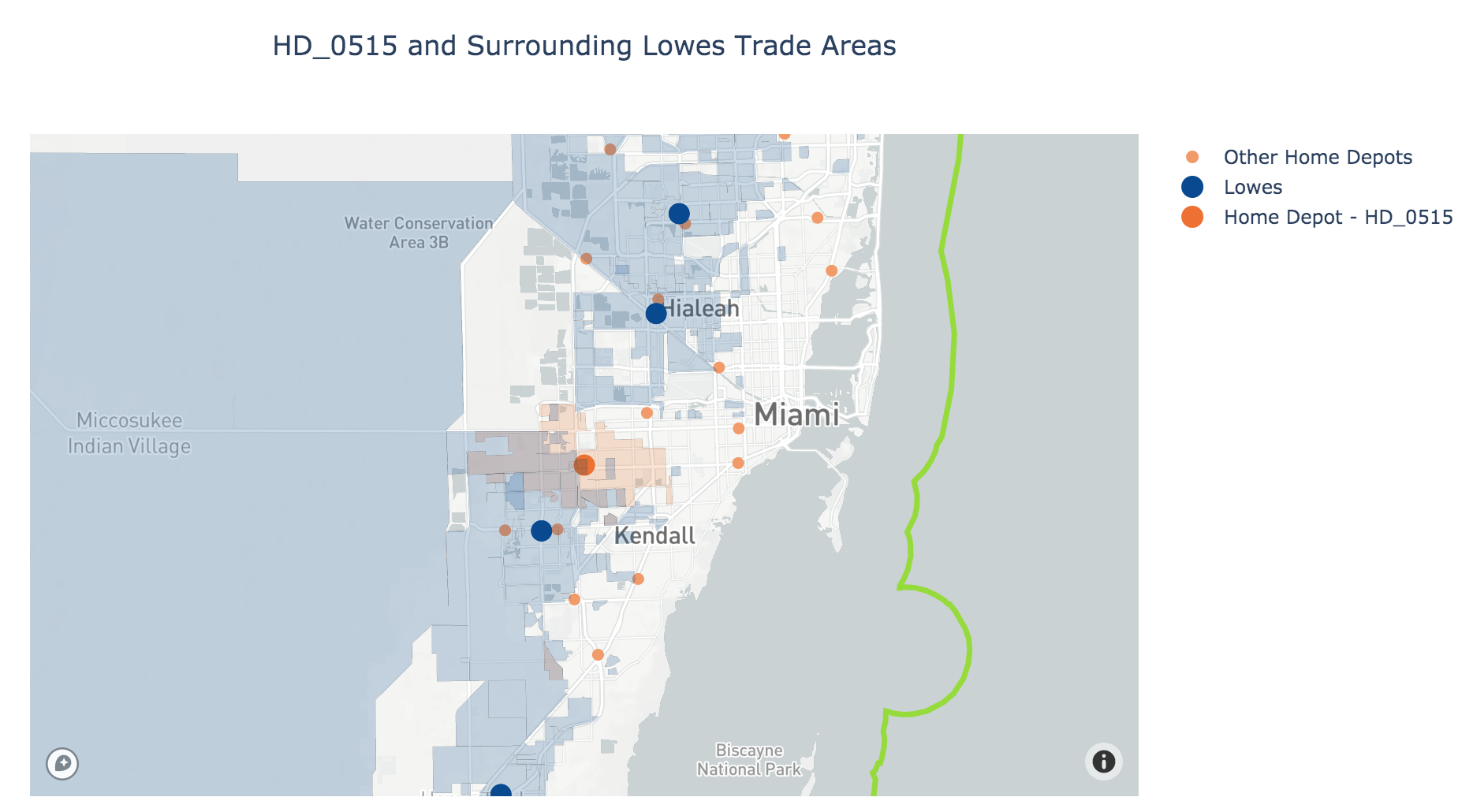

The Two Are Often Near Each Other

GO’s analysis is based on the premise that Home Depot and Lowe’s generally have the same geographic footprint and show little concern about having stores close to one another. Our analysis shows that the median driving time between Home Depot and the closest Lowe’s is 7 minutes. The CBSA with the longest driving time between stores is Miami-Fort Lauderdale, which corresponds with the previous insight that Lowe’s is significantly outnumbered in the region.

Some exceptions may apply to our analysis. Business Insider, for instance, says Home Depot tends to appeal more to professionals — like contractors, interior designers, and plumbers — while Lowe’s welcomes a more do-it-yourself (DIY) crowd. Wedbush Securities analyst Seth Basham told Business Insider that professional contracts accounted for 20% to 25% of sales at Lowe’s and 45% at Home Depot.

A Bank of America survey of 1,000 millennials, reported by US News, also found that 64% of millennials listed Home Depot as the top choice for home-improvement shopping, while 53% preferred Lowe’s.

These findings suggest that the physical distance between the two competitors does not really matter because they attract different demographics and variants within the home improvement market.

Yet as authors David Besanko, David Dranove and Mark Shanley note in the Economics of Strategy (Wiley & Sons, Sept 2009) competing stores in the same location “may cannibalize each other through aggressive pricing and marketing practices”.

Therefore, it makes sense for Lowe’s to carve up a new market for itself, based on its core demographics, in areas where Home Depot is doing exceptionally well.

Also, Lowe’s executive vice president of stores Joseph McFarland said in August the company was paying more attention to professional clients now, posing a greater challenge to Home Depot’s traditional ground.

Analyzing & Comparing The Trade Areas Of Home Depot And Lowe’s

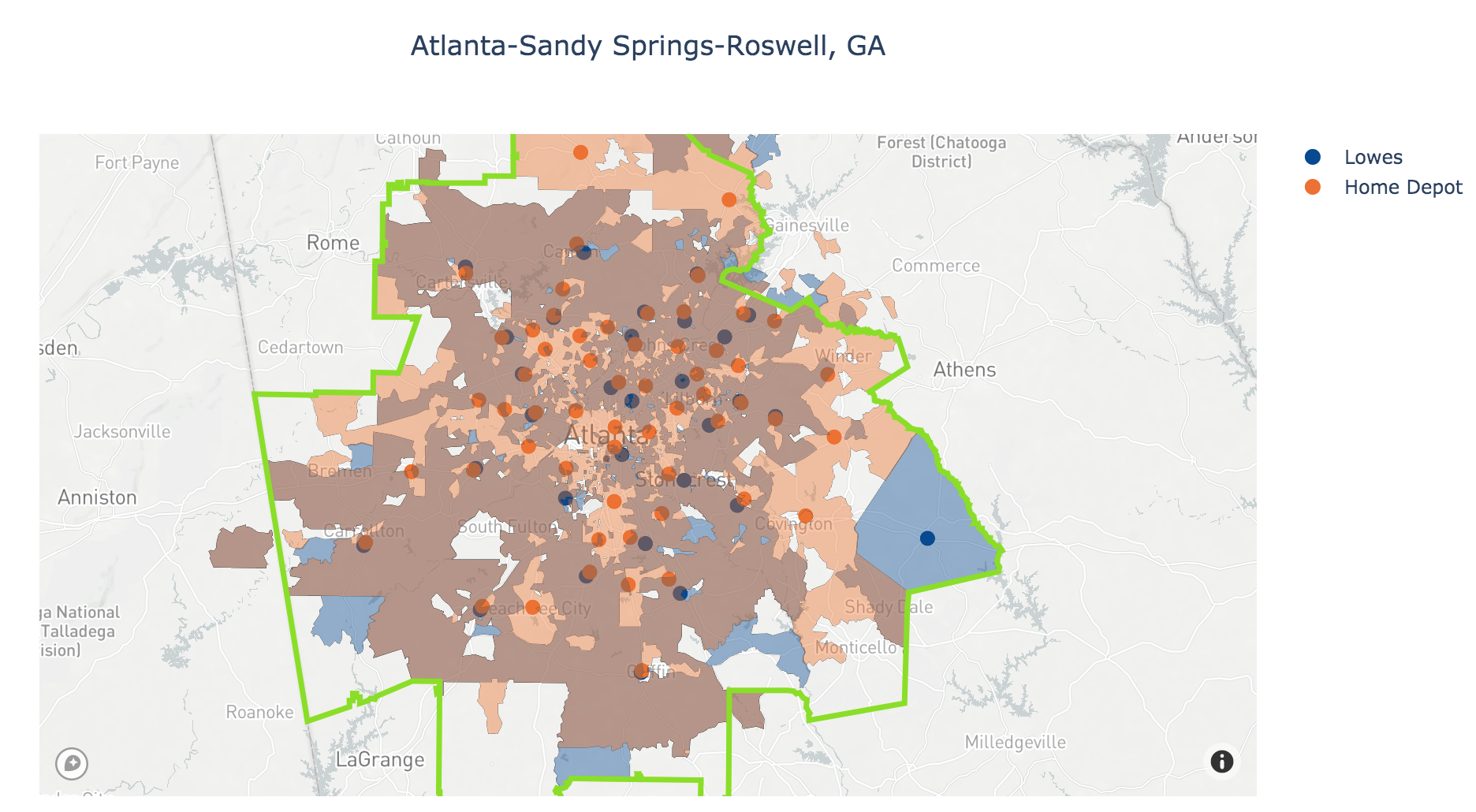

Unlike traditional trade areas calculated by an arbitrary radius, we utilize

quantitative geolocation data to show exactly how many devices from each census block group are visiting a certain store. The following charts show a couple of the fast-growing CBSAs and where the trade areas overlap, or there are uncontested areas.

A Deeper Dive into Trade Area Stats

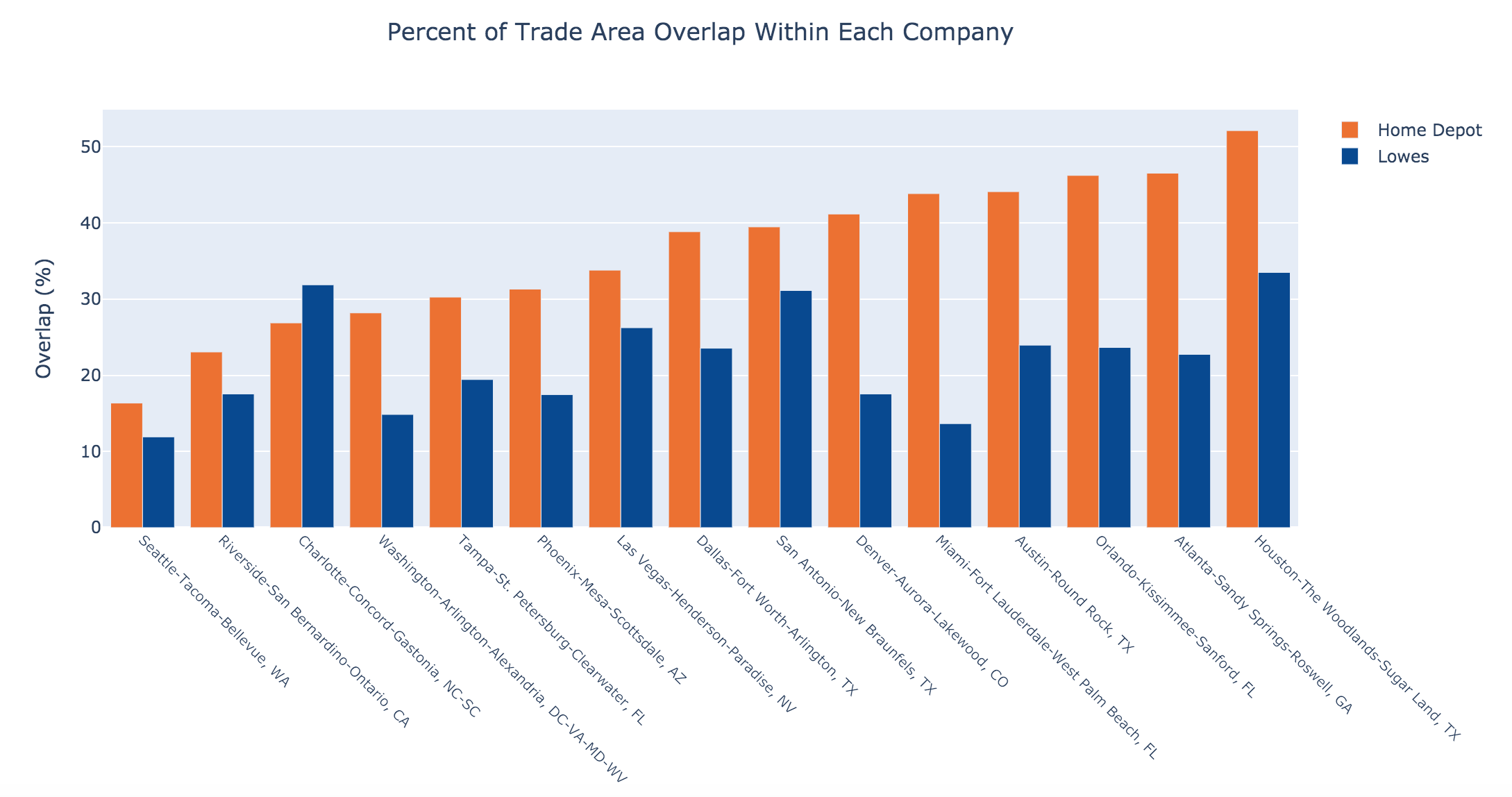

To better quantify how large each company’s trade area, we sum up the total population within the trade areas. We see that except for Charlotte, Home Depot out-covers Lowe’s by about 30%.

One potential reason for the 30% difference in population coverage is that Lowe’s trade areas could overlap with itself, however as we see in the following chart, Home Depots have a significantly higher overlap between their own stores.

Where Is Lowe’s Currently Focusing?

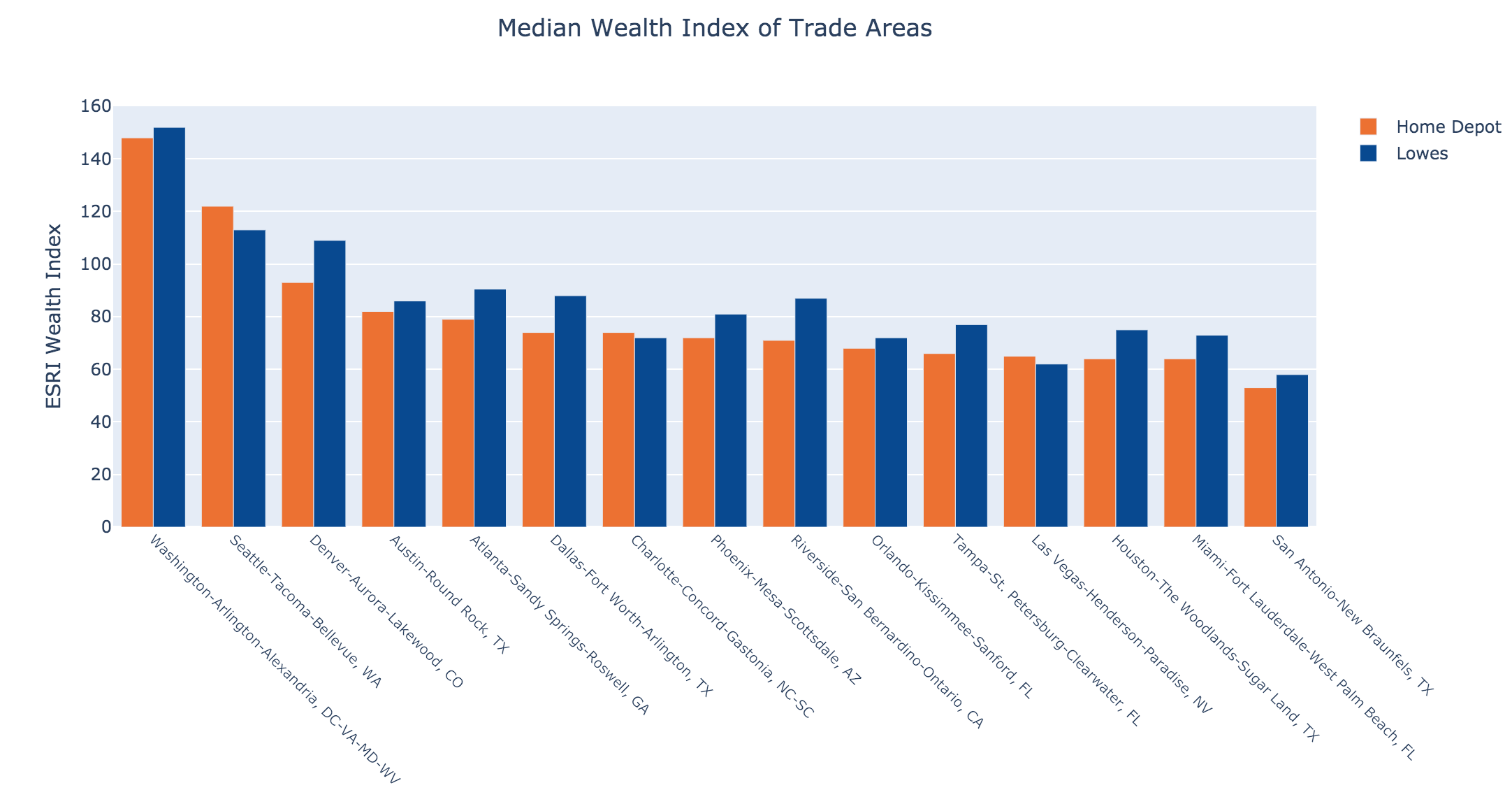

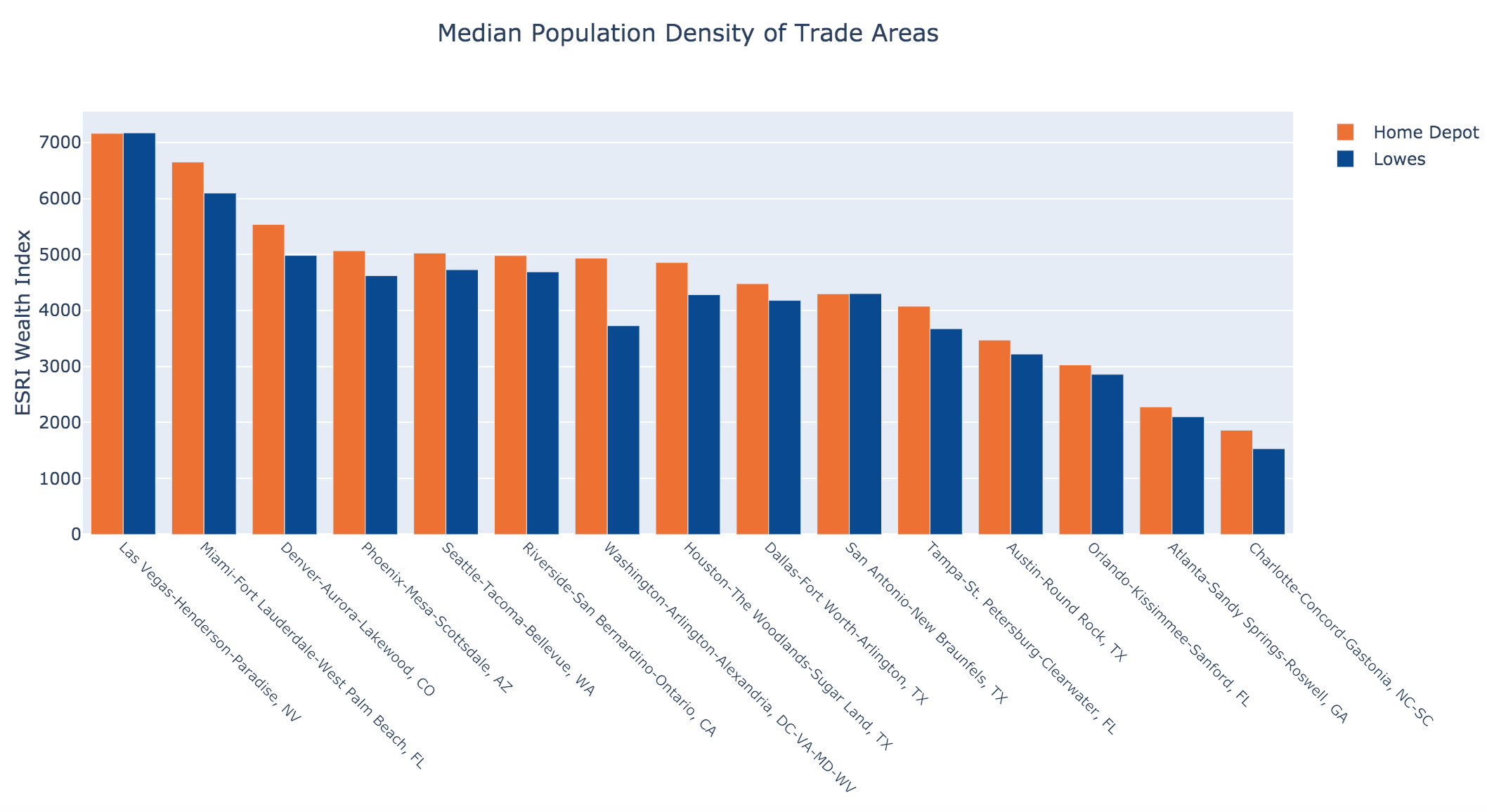

- Lowe’s trade areas cover census blocks that are on average, 10% wealthier

- Lowe’s trade areas cover census blocks that have on average, 8% lower population density

Finding Home Depots That Currently Don’t Have Trade Area Overlap and Fit Lowes’ Profile

Lowes’ trade areas, based on our data, tend to be slightly more wealthy and lower in population density. Our mission is to find areas where Home Depot currently dominates and also fits Lowes existing portfolio.

The chart below compares all the stores where Lowe’s market share is less than 30%. The stores within the green circle fit Lowe’s historical targets and the more bright yellow the point, the larger the total population that is currently uncontested by Lowe’s.

Our search criteria include Home Depot stores that are:

- Within 30% of Lowes historical median wealth target

- Within 30% of Lowes historical median population density

- More than 10 minutes driving distance from an existing Lowes

- Lowes has less than 30% market share

By focusing on the markets with large demographics that can be better served by Lowe’s, we can begin to analyze the trade areas of existing home improvement centers:

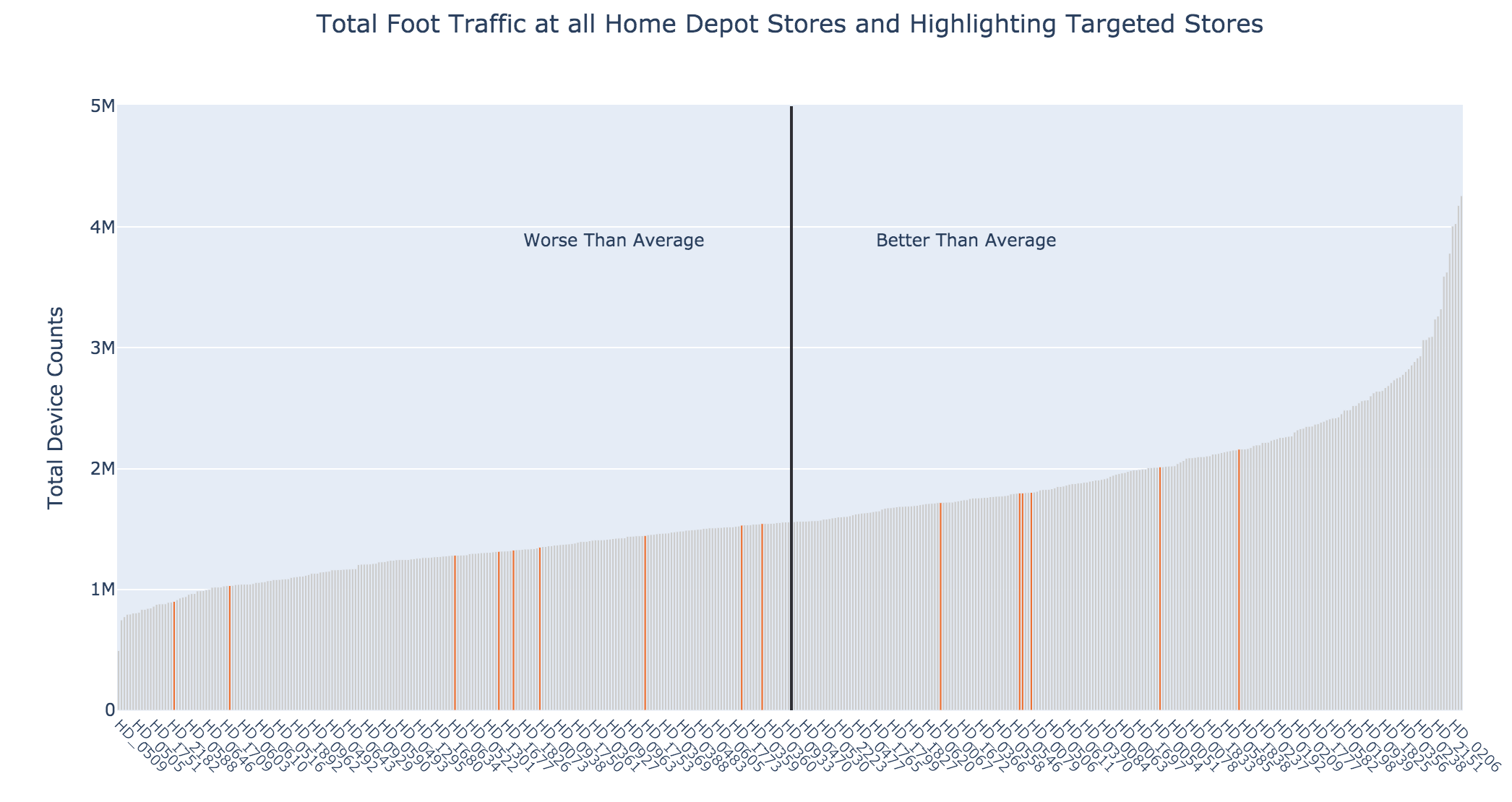

Evaluating Foot Traffic at the Targeted Home Depots

Lastly, we can monitor and rank the targeted Home Depots by their total foot traffic, to see which of the stores that Lowe’s should follow are actually performing well.

And in ranked order, here is where the AI and location intelligence methodology identifies as optimal sites for the next Lowe’s location:

- 2450 Cumberland Pkwy SE, Atlanta, GA 30339

- 3401 Oakwood Blvd, Hollywood, FL 33020

- 6880 W Bell Rd, Glendale, AZ 85308

- 9969 W Camelback Rd, Phoenix, AZ 85037

- 11305 SW 40th St, Miami, FL 33165

- 875 Lawrenceville-Suwanee Rd, Lawrenceville, GA 30043

- 2300 S University D, Davie, FL, 33324, United States

- 4159 Farm to Market 1960 Rd W, Houston, TX 77068

- 9170 E Talking Stick Way, Scottsdale, AZ 85250

- 5351 Diplomat Cir, Orlando, FL 32810

- 60 SW 12th Ave, Deerfield Beach, FL 33442

- 8555 Home Depot Drive, Irving, TX 75063

- 4403 Millenia Plaza Way, Orlando, FL 32839

- 449 Roberts Ct NW, Kennesaw, GA 30144

GO’s Data and Supporting Corporate Strategy

McFarland, the executive vice-president for stores at Lowe’s, says the company’s push is for “unlocking more value in every location”, which includes boosting traffic, transactions, and sales per square foot of productivity.

Orbital Insight GO’s easy-to-use interface makes AI approachable, creating a one-stop-shop of geospatial data — satellite, radar, radio frequency, aerial, connected devices, etc — that is readily deployable at any area of interest.

GO users have supported their corporate strategies, using quick, efficient, and economical geospatial data. Our customers have been able to gain an empirical understanding, as opposed to anecdotal information to sharpen views and gain a decisive edge in order to illuminate supply chains, develop new real estate, prevent deforestation, and further national security.

For more information on gaining activity-based insights using GO, please reach out to insight@orbitalinsight.com